The REIT sector is currently strong. Recent quarterly earnings reports have shown resilience in the face of economic challenges, with many REITs posting solid occupancy rates and even positive rental reversions. With signs of inflation cooling, the Fed may ease its grip on interest rates. This could lower borrowing costs and boost property valuations. It’s no wonder, then, that we’re seeing a wave of analyst upgrades sweeping through the sector. Two standouts in this trend are Equity Residential (EQR) and Realty Income (O).

UBS (UBS) analysts have recently slapped Buy ratings on both, with price targets that suggest significant upside potential. I am bullish on both stocks, given their strong market positioning, resilient performance, and the potential tailwinds from a more favorable interest rate environment.

With that in mind, let’s use TipRanks’ Comparison Tool to break down these two REIT giants: Equity Residential, known for its urban apartment communities, and Realty Income, a retail REIT famous for its dependable monthly dividends.

Both have strong prospects as we move further into the second half of the year, but let’s see how they compare.

Equity Residential (NYSE:EQR)

Equity Residential (EQR) has built quite the portfolio as a big player in the residential REIT space. With 299 properties and nearly 80,000 apartment units across major cities like Boston, New York, D.C., Seattle, San Francisco, and SoCal, it has a strong foothold in some of the most dynamic markets.

EQR’s focus on affluent, long-term renters in these urban hubs has served it well. It has delivered some impressive numbers lately. In Q1 2024, EPS increased 37.5% year-over-year, rising from $0.56 to $0.77. Same-store revenue grew 4.1%, and net operating income (NOI) increased 5.5%, primarily due to robust rental demand and efficient expense management. As of May 24, 2024, its physical occupancy hit 96.5%, up from 96.3% in Q1 and 95.8% in Q4 2023. Plus, its blended rate (defined by the company as the weighted average of new lease change and renewal rate achieved) for May clocked in at a solid 2.9%.

On the stock front, EQR is up about 16.1% year-to-date.

EQR currently boasts an attractive dividend yield of 3.83%, which is a testament to its commitment to returning value to investors.

Analysts have been bullish on Equity Residential, with UBS recently raising its price target from $75 to $82, indicating upside potential of 17.9% from the current stock price. Piper Sandler also upgraded the stock from Neutral to Overweight in June, setting a revised price target of $80, up from $70, citing the company’s strong pricing power in key urban markets.

However, EQR’s focus on specific geographic areas is a double-edged sword. While it allows the company to capitalize on high-demand markets, it also leaves it more exposed to localized economic or regulatory risks.

Speaking of regulatory risks, operating in markets with potential rent control or other changes could dampen EQR’s ability to raise rents and maintain profitability. And let’s not forget the competition. With other housing options vying for renters and the constant need to keep up with the latest amenities and tech, EQR has to stay on its toes.

That said, management seems to have a good handle on things, projecting 2-3% same-store revenue growth for 2024, driven by strength in the firm’s East Coast and SoCal markets. And while the company is keeping an eye on supply in certain areas like San Francisco and Seattle, it’s leveraging operational efficiencies and alternative income streams to navigate any challenges.

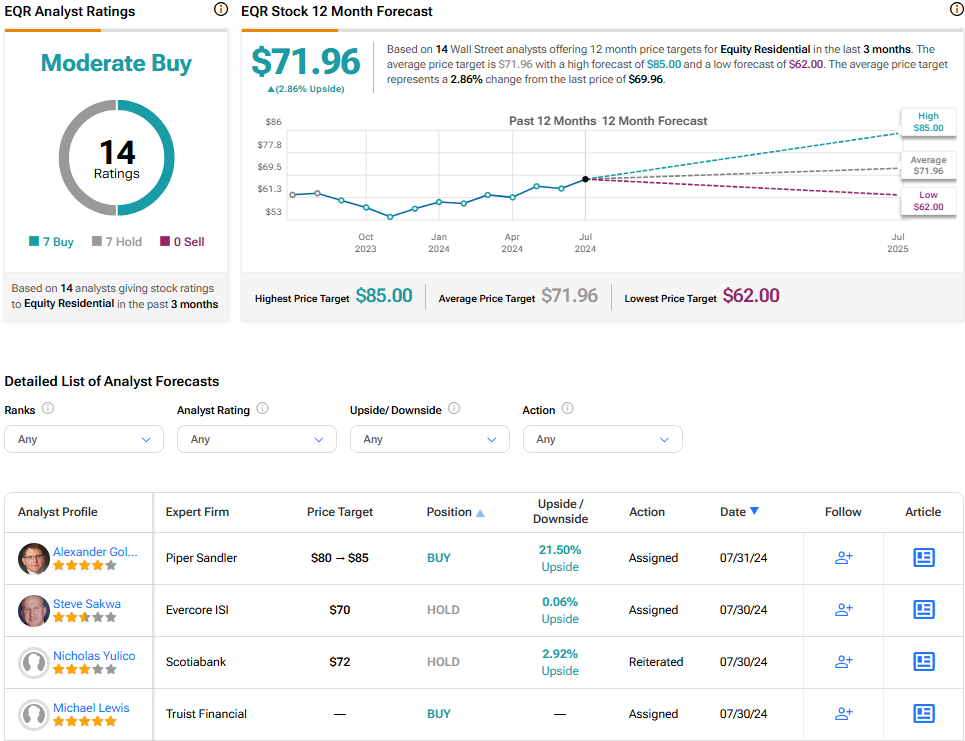

Is Equity Residential Stock a Buy, According to Analysts?

According to the latest analyst ratings, Equity Residential (EQR) stock has a Moderate Buy consensus rating. Seven of the 14 analysts covering the stock rate it a Buy, and the other seven rate it a Hold. The average EQR stock price target is $71.96, which implies upside potential of around 2.9% from the current price.

Realty Income (NYSE:O)

Realty Income (O), also known as “The Monthly Dividend Company,” has been a stalwart in the real estate investment trust sector since its founding in 1969. The company has established itself as a leading real estate partner to businesses worldwide, with a portfolio of over 15,450 properties across the United States, the United Kingdom, and six other European countries. Realty Income primarily invests in commercial properties, including retail, industrial, and office spaces.

The firm even invested $598 million in 155 properties in the first quarter, adding to its impressive collection of real estate. Realty Income has been paying monthly dividends for 32 consecutive years, earning it a spot in the prestigious S&P 500 Dividend Aristocrats® Index. While the stock encountered challenges earlier in the year, it has shown resilience, currently up by about 4.7% year-to-date.

While the company reported impressive revenue growth of 33.5% year-over-year, reaching $1.26 billion, its earnings per share (EPS) tell a different story. EPS for the quarter was $0.16, a significant 53% decline from $0.34 in Q1 2023. This downward trend is further highlighted by the sequential decrease from $0.30 in Q4 2023.

The sharp drop in EPS raises concerns about Realty Income’s profitability, especially in light of rising interest rates and potential tenant issues. For instance, the recent bankruptcy of Rite Aid (RADCQ), one of Realty Income’s tenants, may have contributed to this decline. Additionally, slightly lower occupancy rates and potential dilution from new share issuances to fund acquisitions could be factors impacting the bottom line.

While metrics like revenue growth and AFFO per share (a cash-flow metric used by REITs) showed improvements, the EPS decline is a clear indication of some of the challenges Realty Income faces.

Despite these challenges, Realty Income’s solid fundamentals, diversified portfolio, and proven track record of delivering shareholder value make it an attractive option for income-focused investors. It currently offers a dividend yield of around 5.4% and has raised its 2024 AFFO guidance to $4.15 to $4.21 per share (from a previous range of $4.13 to $4.21. UBS analyst Michael Goldsmith recently maintained a Buy rating on the stock with a price target of $68.00, suggesting a potential 16.5% increase.

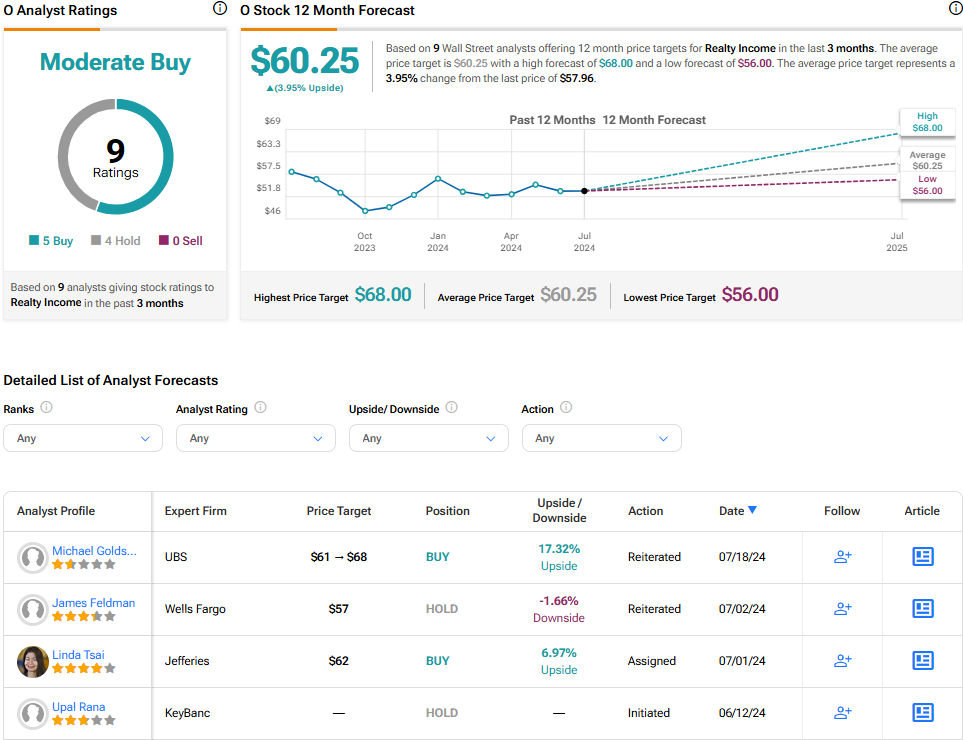

Is Realty Income Stock a Buy, According to Analysts?

According to the latest analyst ratings, Realty Income (O) stock has a consensus rating of Moderate Buy. Out of nine analysts covering the stock, five rate it a Buy, and four rate it a Hold. The average O stock price target is $60.25, which implies upside potential of around 3.95% from the current price.

The Verdict

So, which REIT comes out on top? The answer ultimately depends on what you’re looking for as an investor. If you’re seeking a REIT with strong growth potential, Equity Residential’s impressive revenue growth and strategic focus on high-demand urban markets make it an attractive choice. On the other hand, if reliable income is your top priority, Realty Income’s consistent dividend payouts and diversified tenant base make it a compelling option.

For me, the scales tip slightly in favor of Equity Residential. Its strong financials, growth potential, market resilience, and strategic market positioning really stand out to me. While Realty Income’s consistent dividends are attractive, I’m a bit concerned about its tenant challenges. EQR’s focus on affluent renters and urban markets is a more solid long-term play. That said, both are quality REITs.

In my view, I’m bullish on Equity Residential and cautiously optimistic about Realty Income. EQR’s strong fundamentals and growth prospects make it a more compelling buy right now, while Realty Income’s dividend consistency keeps it on my watchlist despite some headwinds.