Shares of EQT Corporation (EQT) increased 3.1% in the extended trading session on Monday after the American energy company engaged in hydrocarbon exploration and pipeline transportation disclosed its capital deployment plan.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The plan includes a share repurchase authorization, the reinstatement of a dividend, and a long-term leverage target update.

Share Repurchase Plan

EQT’s board of directors has authorized a stock repurchase program of $1 billion. The new authorization is effective immediately and will be conducted until December 31, 2023.

The company is expected to fund the share buyback plan through its existing working capital and cash provided by operating activities.

Reinstatement of Cash Dividend

EQT’s Board of Directors has reinstated its quarterly cash dividend of $0.125 per share of its common stock. The dividend payment will be initiated in the first quarter of 2022.

The company’s annual dividend of $0.50 per share will reflect a dividend yield of 2.5%.

For 2022, EQT expects to generate a free cash flow of around $1.9 billion and an average of around $1.6 billion per year from 2023 through 2026.

Long-Term Leverage Target

EQT has updated its long-term leverage target to 1.0x – 1.5x from 1.0x or less. To achieve the target, the company plans to reduce its debt by a minimum of $1.5 billion by the end of 2023.

The company expects the achievement of the target will result in investment-grade financial metrics during 2022, aiding credit rating upgrades and enabling future financial flexibility.

See Insiders’ Hot Stocks on TipRanks >>

CEO Comments

EQT CEO Toby Rice stated, “Since joining EQT in July 2019, our team has eliminated approximately $500 million of recurring annual costs from the business, repaired the balance sheet, and repositioned EQT as a highly-efficient, technology-driven operator and the leading producer of natural gas in North America. We have entered the next phase of the sustainable shale era – one that values free cash flow generation, balance sheet strength, emissions reduction and returning capital to shareholders.”

“With a premier asset base projected to generate approximately $5.6 billion in available cash through 2023 and over $10 billion through 2026 we have ample flexibility to achieve both our debt reduction goals and execute capital return initiatives in any price environment. We are excited to announce the next step in our evolution as we establish the groundwork for a long-term capital returns program to maximize shareholder value creation,” Rice added.

Wall Street’s Take

Last month, Morgan Stanley (MS) analyst Devin McDermott upgraded the stock to a Buy from a Hold and increased the price target to $31 (54.08% upside potential) from $24.

Consensus among analysts is a Strong Buy based on 8 Buys and 2 Holds. The average EQT forecast of $30.20 implies 50.1% upside potential to current levels. Shares have jumped 45% over the past year.

Risk Analysis

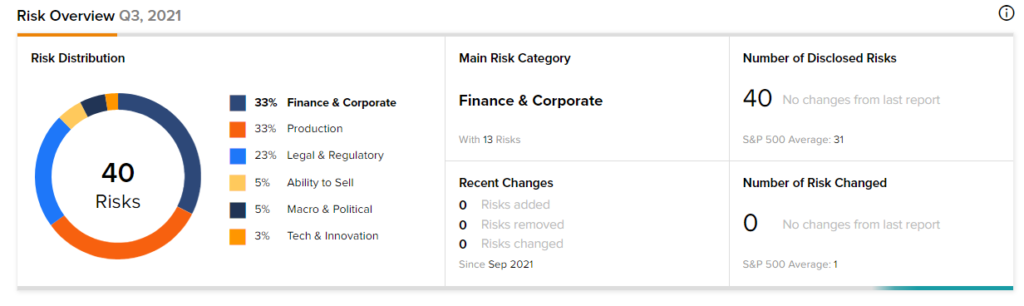

According to the new TipRanks Risk Factors tool, EQT stock is at risk mainly from three factors: Finance and Corporate, Production, and Legal and Regulatory, which contribute 33%, 33%, and 23%, respectively to the total 40 risks identified for the stock.

Related News:

Kraft Heinz Inks Deal to Buy Just Spices; Shares Gain

Phillips 66 Unveils 2022 Capital Plan Worth $1.9B

T. Rowe Price’s AUM Decline in November; Shares Fall