Envista Holdings Corporation (NVST) has entered into a deal to acquire Carestream Dental’s Intra-Oral Scanner (IOS) business. The purchase price has been fixed at $600 million, and the transaction is expected to close in the second quarter of 2022.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Shares of the dental equipment and supplies manufacturing company rallied 7.6% on Wednesday and a further 2.8% in the after-hours to close at $45.99.

With this deal, Envista will be able to improve its focus on the fast-growing dental market segments and to create differentiated solutions via the digitalization of dental workflows. The acquired business is said to be complementary to both Envista’s Equipment and Consumables segment, and the Specialty Products and Technologies segment.

Envista CEO, Amir Aghdaei, said, “We are excited to add a suite of world-class intra-oral scanners and software to our portfolio. This acquisition further enables our purpose of partnering with dental professionals to improve patients’ lives by digitizing, personalizing, and democratizing dental care.”

Wall Street’s Take

Following the news, Piper Sandler analyst Jason Bednar maintained a Hold rating on the stock with a price target of $47 (5% upside potential).

Meanwhile, the Street is optimistic about the stock with a Strong Buy consensus rating based on 4 Buys and 1 Hold. The Envista stock price prediction of $50.40 implies 10.55% upside potential.

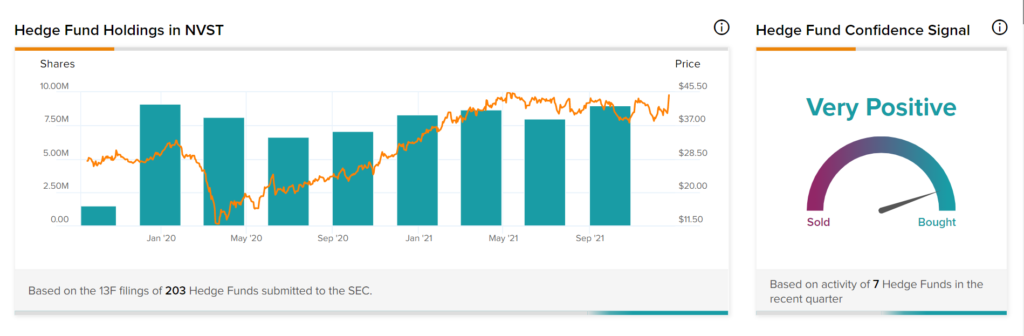

Increased Hedge Fund Activity

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Envista is currently Very Positive, as the cumulative change was an increase of one million shares in holdings across all 7 hedge funds that were active in the last quarter.

Related News:

CarMax Plunges 6.7% Despite Robust Q3 Results

Paychex Jumps 5.5% on Strong Q2 Results, Updates Outlook

Allakos Reveals Topline Results from ENIGMA 2 & KRYPTOS Studies; Shares Crash