ASX-listed Endeavour Group Limited (AU:EDV) fell nearly 5% after the company issued a weak outlook for its Retail business. For the first half of FY25, the company expects its Retail operating EBIT (earnings before interest and tax) margin to be between 7.0% and 7.5%, compared to 8% in H1 FY24. Endeavour Group reported mixed trading results for Q1 amid the ongoing cost-of-living pressures and sluggish market conditions.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Endeavour Group (EG) is a retail company specializing in alcoholic beverages, hotel management, and poker machine operations.

Endeavour Group’s Q1 Results Show Mixed Performance

In Q1, Endeavour Group witnessed flat sales in its Retail business compared to the first quarter of FY24. Moving ahead, the company expects its retail profitability to be affected by weaker sales and a lower-margin sales mix.

On the other hand, its Hotels business achieved 2.5% year-over-year sales growth, reaching AU$567 million. The company further highlighted the strength of the Hotels segment, despite the tight household budgets.

Overall, Endeavour’s first quarter sales grew by 0.5% to AU$3.11 billion. The company also stated that cost inflation will remain a headwind for both Retail and Hotels segments.

Analysts Weigh in on EDV Update

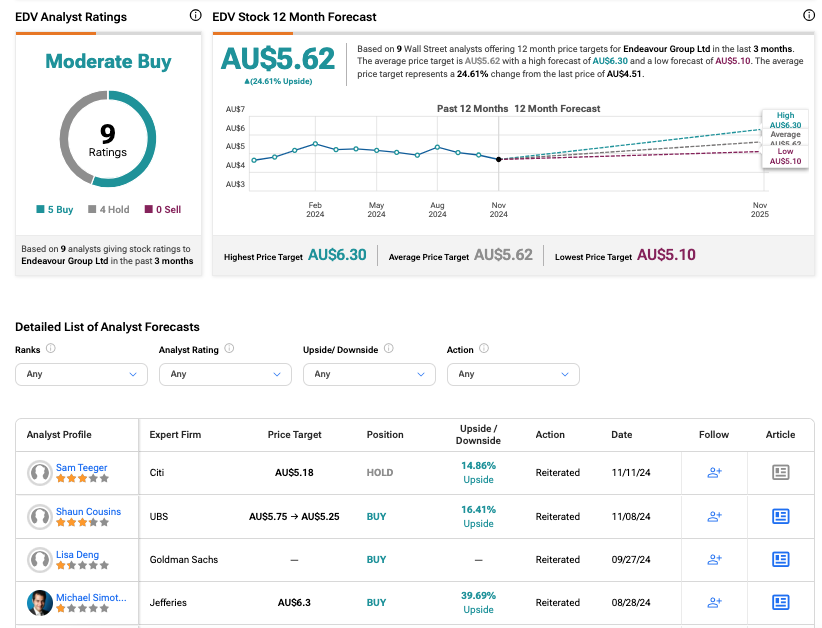

Citi analyst Sam Teeger expressed disappointment over the lack of an update on Endeavour’s CEO transition. The company is currently searching for a new CEO after Steve Donohue announced his intention to step down from the role in September.

Teegar confirmed a Hold rating on EDV stock, predicting an upside of 15%.

Additionally, analysts from Jefferies believe that achieving retail sales growth in the second quarter will be difficult for the company, considering the cost inflation.

Is Endeavour Group a Good Buy?

According to TipRanks, EDV stock has received a Moderate Buy rating, backed by five buy and four Hold recommendations. The Endeavour Group share price target is AU$5.62, which implies an upside of 24.6% from the current trading level.

Year-to-date, EDV stock has lost 14.12%.