Shares of Endeavor Group Holdings, Inc. (EDR) gained 3.5% in pre-market trading on Tuesday after the global entertainment, sports, and content company reported mixed Q2 results.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company reported an adjusted loss of $1.24 per share that fell significantly short of analysts’ expectations of a loss of $0.02 per share.

Positively, however, revenues more than doubled year-over-year to $1.11 billion and almost met consensus estimates of $1.14 billion. The growth in revenue was driven by robust performance across all segments. (See Endeavor Group Holdings stock charts on TipRanks)

Segment-wise, Owned Sports Properties revenue jumped 70% year-over-year to $106.6 million. Events, Experiences & Rights segment revenue increased by $408.8 million to $528.7 million, while Representation segment revenue grew 70.2% to $328.2 million.

Looking ahead, the company provided its full-year guidance. Revenues are forecast to be in the range of $4.8 – $4.85 billion, versus the consensus estimate of $4.79 billion. The company forecasts adjusted EBITDA in the range of $765 – $775 million.

Endeavor CEO Ariel Emanuel commented, “As you look at the secular trends defining our industries – marked by the growing demand for content, the increased value of the talent and brands behind that content, and the desire of people to come together around live events and experiences – Endeavor remains firmly and uniquely positioned for a strong second half of 2021.”

Following the Q2 results, Piper Sandler analyst Thomas Champion decreased the price target on Endeavor Group from $35 to $33 (42.9% upside potential) while reiterating a Buy rating.

Champion reduced the price target based on his concerns and uncertainty related to the impact of the Delta variant on the company’s results.

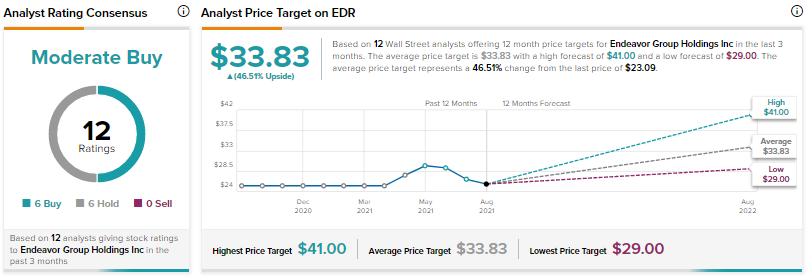

Overall, the stock has a Moderate Buy consensus rating based on 6 Buys and 6 Holds. The average Endeavor Group Holdings price target of $33.83 implies 46.5% upside potential from current levels.

Related News:

Forma Therapeutics Holdings Shares Fall 4.5% on Q2 Miss

HSBC Holdings to Snap up Axa Singapore for $575 million – Report

Badger Meter Bumps up Quarterly Dividend by 11%