Empire (EMP.A), the owner of grocery chains Sobeys, Safeway, FreshCo, IGA, FreshCo and others, reported higher sales and profit in the second quarter than in a year earlier, benefitting from a rise in fuel volumes.

Sales & Earnings

Sales came in at C$7.32 million for the quarter ended October 30, 2021, an increase of 4.9% from C$6.98 million from the prior-year quarter.

The rise in sales was mainly due to the acquisition of Longo’s, increased fuel sales and the benefits of Project Horizon initiatives, including the expansion of Farm Boy and Voilà in Ontario and FreshCo in Western Canada. The increase was partially offset by stabilizing consumer buying behavior as COVID-19 restrictions relaxed across the country.

Same-store sales excluding fuel decreased by 1.3% compared to high sales last year. (See Analysts’ Top Stocks on TipRanks)

Net income for Q2 2022 amounted to C$175.4 million (C$0.66 per share), up from C$161.4 million (C$0.60 per share) in the same quarter a year ago.

Management Commentary

Empire president and CEO Michael Medline said, “We see strong momentum as we continue to improve our operations and execute on our key Project Horizon initiatives. Sales were strong, up 4.9% over last year and 13.7% over two years ago. We are delivering two-year same-store sales growth of 6.8%, and at the same time our margins keep improving. I’m very pleased with our team’s consistent and growing ability to deliver results to our customers and shareholders.”

Outlook

Empire does not expect grocery consumer behavior to fully return to pre-pandemic levels in the foreseeable future. As economic activity increases and travel restrictions decrease, fuel volumes have increased and will likely continue to do so through the remainder of fiscal 2022.

Wall Street’s Take

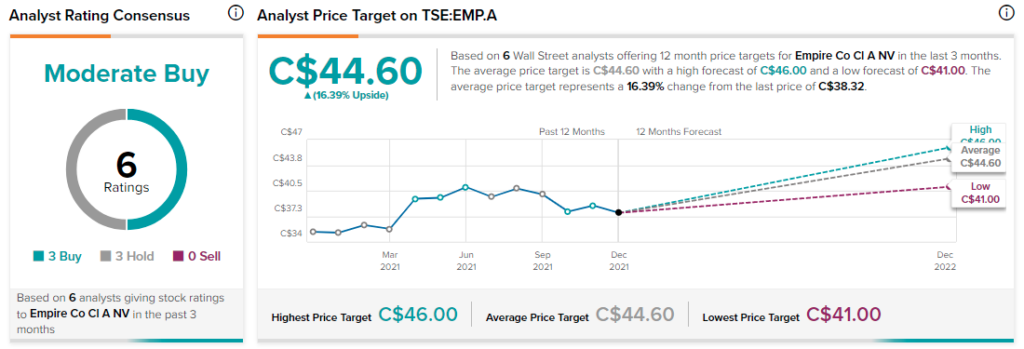

Two days ago, BMO Capital analyst Peter Sklar downgraded EMP.A from Buy to Hold with a C$41 price target. This implies 7% upside potential.

Consensus among analysts is that EMP.A is a Moderate Buy based on three Buys and three Holds. The average Empire Co price target of C$44.60 implies 16.4% upside potential to current levels.

Related News:

Dollarama Q3 EPS Rises 17.3%, Beats Estimates

good natured Products Q3 Loss Widens; Shares Plunge

George Weston Posts Lower Q3 Profit

Questions or Comments about the article? Write to editor@tipranks.com