Emerson (NYSE:EMR) has announced the sale of its remaining 40% stake in the Copeland joint venture (JV) to private equity funds managed by Blackstone (NYSE:BX) for approximately $3.5 billion. This strategic move aligns with Emerson’s ongoing efforts to optimize its portfolio and focus on high-growth sectors within the automation industry.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The sale transaction is projected to close in the second half of 2024, and Emerson plans to use the proceeds to reduce its debt.

EMR is a leading technology and software company specializing in automation solutions.

Emerson’s Strategic Shift Towards Growth

Emerson has been reshaping its business portfolio to strengthen its position in the automation domain. The divestiture of the Copeland JV is an important step in that direction. The JV was formed in October 2022 after it sold a majority stake in its Climate Technologies business to Blackstone. The deal was part of the company’s broader strategy to pivot towards high-growth industry verticals and advanced technology segments.

Lal Karsanbhai, EMR’s President and CEO, said the recent transaction provides “certainty and portfolio simplification” for Emerson shareholders. This move is expected to enhance Emerson’s focus on growing automation markets.

In 2023, Emerson acquired National Instruments, a provider of software-connected automated test and measurement systems. The deal significantly boosted Emerson’s automation capabilities. Moreover, in 2022, Emerson merged its industrial software businesses with AspenTech (NASDAQ:AZPN). It owns a majority stake of about 55% in the company.

Is Emerson Stock a Good Buy?

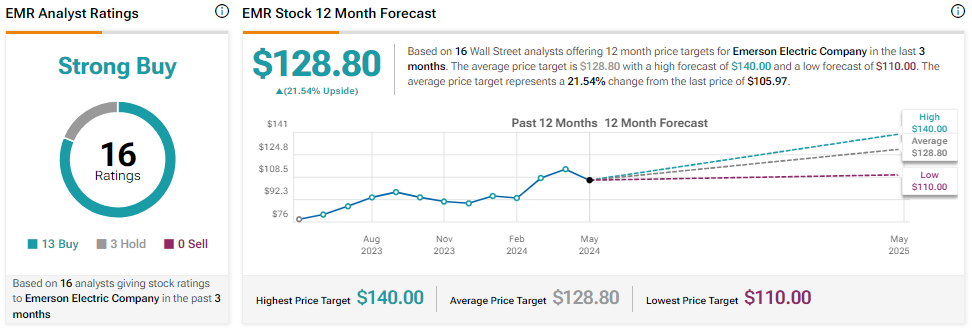

Wall Street is bullish about Emerson stock. It has 13 Buys and three Hold recommendations for a Strong Buy consensus rating.

Emerson stock has gained over 28% in one year. The analysts’ average price target for EMR stock is $128.80, implying an upside potential of 21.54% from current levels.