Tesla’s (TSLA) CEO, Elon Musk‘s acquisition of the social media platform X, formerly known as Twitter, is proving to be a problematic deal for banks. Musk acquired X for $44 billion in October 2022, taking the company private. As part of this acquisition, seven banks, including Morgan Stanley (MS) and Bank of America (BAC), lent Musk $13 billion to finance the purchase. However, a Wall Street Journal report describes this loan as the worst merger-finance deal for banks since the 2008 financial crisis. With that in mind, let’s explore the reasons behind this viewpoint.

Why Is the Deal Troublesome For Banks?

Typically, banks that provide debt for takeovers quickly sell these loans to investors such as hedge funds and pension plans. Unfortunately, due to X’s weak financial performance, these banks have been unable to offload the debt without incurring major losses. As a result, this debt—referred to as “hung” debt—remains stuck on the banks’ balance sheets, leading to significant write-downs and damaging their finances.

Adding more context, the WSJ report, citing data from PitchBook LCD, notes that the Twitter loans have been lingering on the banks’ balance sheets longer than any similar unsold deal since the 2008-09 financial crisis. The report also highlights that the banks still chose to finance Musk’s deal, even though he admitted it was overvalued, likely due to the “allure of banking the world’s richest person.”

While these banks have been able to collect hefty interest payments from X for this debt, X’s business struggles continue. Indeed, last year, X disclosed that its value had fallen by more than 50% to $19 billion. Now, let’s delve into the details of this debt and whether X will be able to repay these loans.

X Faces Huge Debt Challenge

When Musk struck the deal to buy X, the social media platform was expected to manage over $1 billion in annual interest expenses, before capital and operating expenses. However, this poses a significant challenge, as a Fortune report suggests that revenue might only reach $600 million this year, making it difficult for the company to cover its interest obligations. Even before Musk’s acquisition, Twitter struggled to monetize its user base.

Moreover, according to another Fortune report, Musk attempted to restructure the debt, but talks stalled, affecting lenders like Barclays (BCS). For Barclays, this Twitter debt sitting on its balance sheet led to the senior management team in the mergers and acquisitions department being told to accept a 40% pay cut, prompting over 200 resignations. Among the “hung” debts on Barclays’ balance sheet, X’s debt was the largest.

What Does Musk’s Acquisition of X Mean for TSLA?

Not surprisingly, X’s floundering financial performance and concerns over its ability to repay its debt are causing alarm among Tesla investors, too. According to a Fortune report citing financial advisor Halter Ferguson Financial, it’s believed that Musk may need to sell $1 billion to $2 billion in Tesla shares to raise funds through a stock sale to address X’s financial troubles.

Is Tesla Buy or Sell?

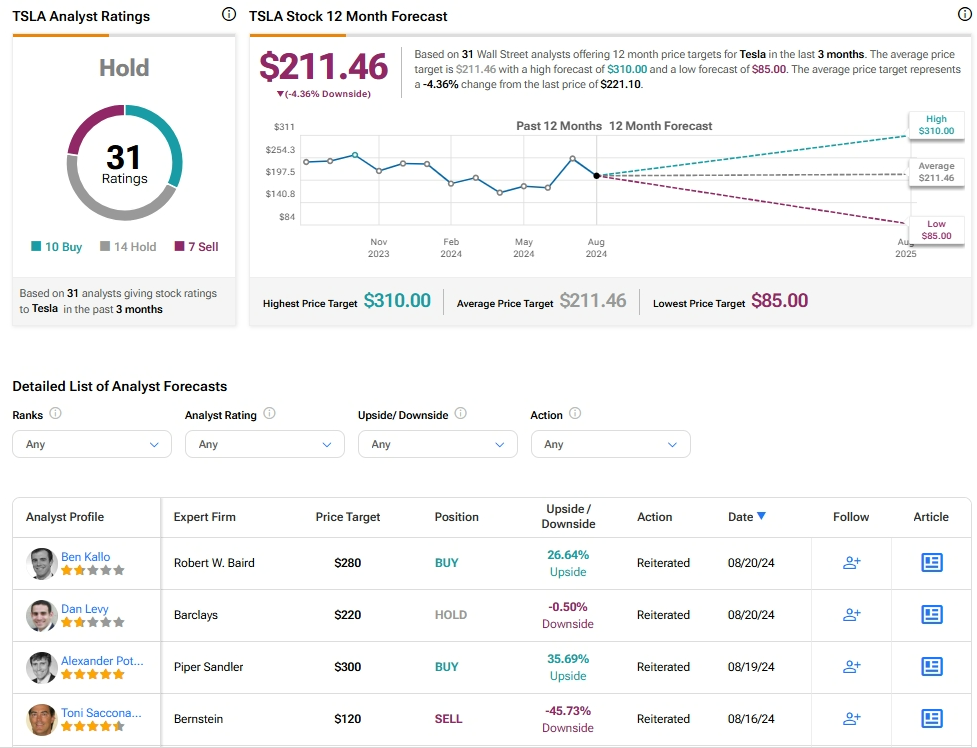

Analysts remain sidelined about TSLA stock, with a Hold consensus rating based on 10 Buys, 14 Holds, and seven Sells. Year-to-date, TSLA has declined by more than 10%, and the average TSLA price target of $211.46 implies a downside potential of 4.4% from current levels.

Questions or Comments about the article? Write to editor@tipranks.com