Elon Musk plans to finance his proposed acquisition of Twitter (TWTR) with debt and equity, according to a SEC filing. Musk plans to pledge Tesla (TSLA) stock as collateral to secure loans to fund the acquisition.

Musk said that he had secured $46.5 billion in funding commitments to pay for the Twitter acquisition. That is more than the $43 billion that his unsolicited buyout offer valued the social media company. According to the Bloomberg Billionaires Index, Musk is the world’s richest person with a fortune of about $260 billion.

Leveraging Tesla Stock to Foot Twitter Buyout Bill

Much of Musk’s wealth is tied to his stake in electric automaker Tesla. A group of banks that includes Morgan Stanley (MS), Bank of America (BAC), and Barclays (BCS) has agreed to loan Musk funds to buy Twitter.

However, the loan would only provide a fraction of the money needed to pay for the acquisition. Musk plans to raise the remaining money through equity, which may mean selling some of his Tesla shares. To raise the money, he may also need to reduce his stakes in privately held SpaceX and Boring Company. The Boring Company builds underground transportation infrastructure, while SpaceX is a spaceflight company whose customers include NASA.

Is Twitter Ready to Sell to Musk?

Twitter’s board is reviewing Musk’s updated buyout proposal, which now includes financing details. Meanwhile, the board has adopted the so-called poison pill measure that would make it difficult for Musk to do a hostile takeover of the social media company. If the board cannot accept his buyout proposal, then Musk is considering going directly to Twitter shareholders with a tender offer.

Wall Street’s Take

On April 21, Truist Financial analyst Youssef Squali downgraded Twitter to a Hold from a Buy with a $50 price target, which indicates 6.2% upside potential.

The stock has a Hold consensus rating based on four Buys, 23 Holds, and three Sells. The average Twitter price target of $45.84 implies 2.6% downside potential from current levels.

News Sentiment

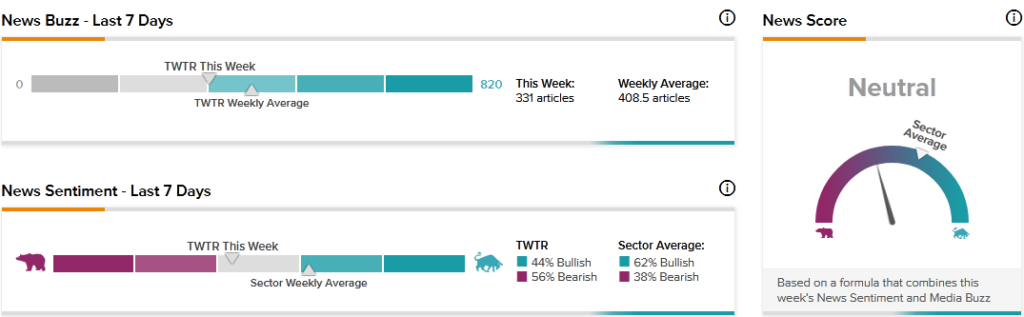

TipRanks data shows that the News Score for Twitter is currently Neutral based on 331 articles published over the past seven days. Notably, 44% of the articles have a Bullish Sentiment compared to a sector average of 62%, while 56% of the articles have a Bearish Sentiment compared to a sector average of 38%.

Takeaway for Investors

The commitment by major banks like Morgan Stanley, Bank of America, and Barclays to provide financing suggests Musk is serious about buying Twitter. However, there may be a struggle before the deal is sealed, with the Board possibly demanding a higher price. For investors wishing to bet on the buyout, there is still room to do so, considering Twitter stock currently trades at a discount to the price Musk has offered to pay for it.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

On24 to Empower Marketers Through Latest Acquisition

Snap Survives Q1 Miss Through Encouraging Q2 DAU Forecast

Accenture Continues Acquisition Spree with Ergo