Eli Lilly and Co. (NYSE:LLY) recently released encouraging results from its Phase 3 trial of donanemab, an Alzheimer’s treatment drug. The trial demonstrated a significant slowdown in disease progression for patients in the early stages. Importantly, LLY completed the submission of donanemab to the U.S. Food and Drug Administration (FDA) and is now awaiting regulatory action by the end of 2023.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

At the Alzheimer’s Association International Conference in Amsterdam, Lilly presented data from the study involving over 1,700 patients aged 60 to 85. In this group, donanemab was found to successfully slow the decline of tau, a brain protein linked with disease progression, by an impressive 40% to 60%.

However, the drug comes with serious side effects, such as brain swelling or bleeding, which may not show noticeable symptoms. About a quarter of donanemab recipients in the study exhibited evidence of brain swelling, and about 20% had microbleeds. Even more concerning, the data revealed that three participants with severe brain swelling or bleeding issues died during the trial.

It is worth mentioning that earlier this month, Biogen (BIIB) received full approval from the FDA for its Alzheimer’s drug Leqembi. Like donanemab, Leqembi is a monoclonal antibody that targets amyloid plaque in the brain, a marker of Alzheimer’s disease.

Recent Developments

Last week, LLY agreed to acquire Versanis, a private biopharmaceutical company specializing in developing treatments for cardiometabolic diseases. With this buyout, Lilly aims to bolster its presence in the obesity market.

The deal grants Lilly access to Versanis’ lead pipeline candidate, bimagrumab. Bimagrumab is a monoclonal antibody currently under development in a phase IIb study, both as a standalone therapy and in combination with semaglutide. The focus of the study is on adults who are overweight or obese.

What is the Price Target for LLY Stock?

Overall, Wall Street is optimistic about LLY stock. It has a Strong Buy consensus rating based on 16 Buys and two Holds. The average price target of $483.34 implies 8.1% upside potential from the current level.

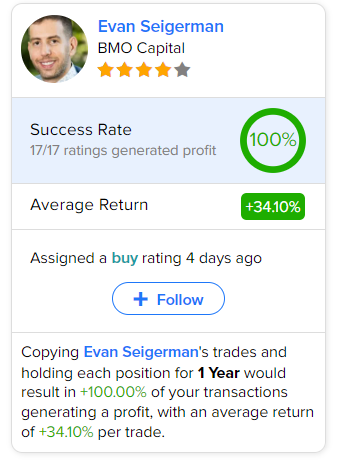

As per TipRanks data, the most accurate and profitable analyst for Lilly is BMO Capital analyst Evan Seigerman. Copying the analyst’s trades on this stock and holding each position for one year could result in 100% of your transactions generating a profit, with an impressive average return of 34.1% per trade.