2023 belonged to the tech giants but not exclusively so. A giant of another kind giant had an excellent year. Driven by the buzz around weight loss drugs and its promising pipeline, shares of Eli Lilly (NYSE:LLY) have surged by 73% over the past 12 months.

Investors will surely be hoping for more of the same this year. At a recent industry conference, the company discussed its business targets for the year ahead and, further down the line, its objective of enhancing R&D efficiency. The discussion also highlighted the potential for significant revenue growth driven by incretin sales.

Goldman Sachs analyst Chris Shibutani thinks products like Zepbound in chronic weight management and Mounjaro in diabetes could be set for “potentially unprecedented revenue growth,” estimating that by 2030 its incretin portfolio could be worth more than $50 billion.

“Messaging highlighted that LLY will likely not grow via numerous small ideas, but rather the company needs a few big ideas that address unmet medical needs in large populations,” the analyst noted.

Management clearly stated that it intends to remain engaged in external business development, and given management’s take that revenue-stage companies come with certain challenges, Shibutani thinks LLY will “continue to primarily conduct transactions with earlier-stage, less-validated assets.”

As for potential areas of interest, LLY emphasized its active involvement in emerging modalities, such as nucleic acid therapeutics. The company expressed an interest in engaging with companies’ platforms or pipelines where they can bring some value to the table.

But while Shibutani believes the company has an “unprecedented revenue opportunity,” he has a problem with the stock’s valuation.

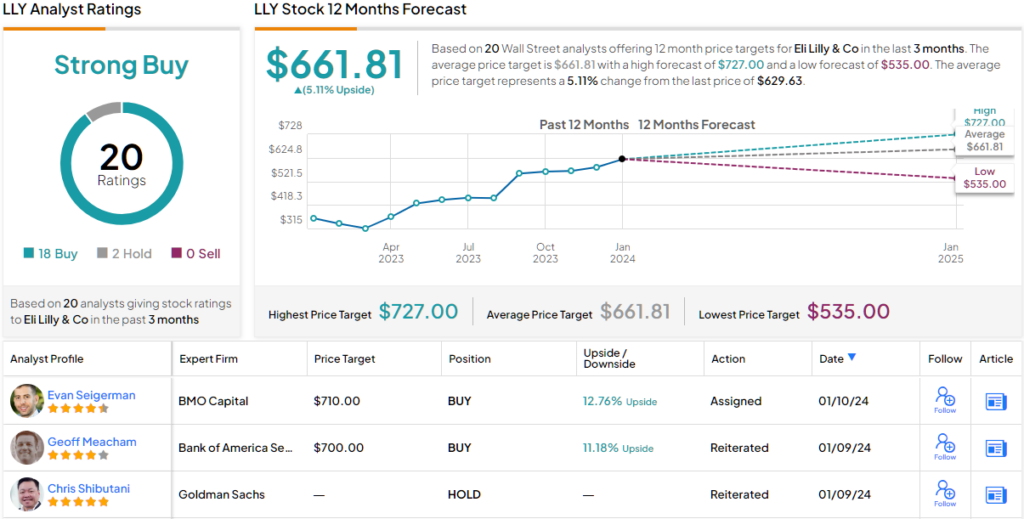

“We maintain our Neutral rating on LLY shares as we believe the company’s performance prospects are fairly balanced at current levels, with valuation reflecting substantial expectations for success across commercial franchises and the clinical pipeline,” the 5-star analyst went on to explain.

That Neutral rating is backed by a $600 price target, which suggests the shares will stay range bound for the foreseeable future. (To watch Shibutani’s track record, click here)

However, Shibutani belongs to a very small group of LLY skeptics. One other analyst joins him on the fence, but all 18 other recent reviews are positive, providing the stock with a Strong Buy consensus rating. That said, the $661.81 average target makes room for only modest gains of 5% over the next 12 months. (See LLY stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.