Eli Lilly and Company (LLY) has filed a lawsuit against a federal health agency over its hospital drug discount plans. After the heads of the U.S. Department of Health and Human Services blocked the company’s attempt to tighten the drug discounts it provides to hospitals, Eli Lilly filed the lawsuit in a Washington, D.C., federal court. This move indicates that the pharmaceutical company is seeking to change how it offers drug discounts. So far, this news has not been favorable for LLY stock.

What’s Happening with Eli Lilly Stock Today?

News of the lawsuit broke after markets closed yesterday. Since then, Eli Lilly stock has struggled in pre-market trading, following a red close yesterday. This comes after a week of slow, gradual decline and several months of volatility, during which LLY stock has mostly trended downward. As of this writing, shares are down 15% over the past three months.

Eli Lilly isn’t the first pharmaceutical company to file a lawsuit against a federal agency over drug discounts recently. Earlier this week, the Health Resources and Services Administration rejected a plan from Johnson & Johnson (JNJ) requiring participating hospitals to pay full prices for drugs upfront before waiting for a rebate. This prompted the company to file a legal challenge against the decision.

The Wall Street Journal reports that both lawsuits are part of an industry effort to overhaul the federal 340B program. Since 1992, this policy has required pharmaceutical companies to provide outpatient drugs at discounted prices to hospitals and clinics serving economically disadvantaged communities. However, the fact that two leading companies in the industry are issuing legal challenges suggests they are pushing for changes at the federal level.

Wall Street Remains Highly Bullish on Eli Lilly Stock

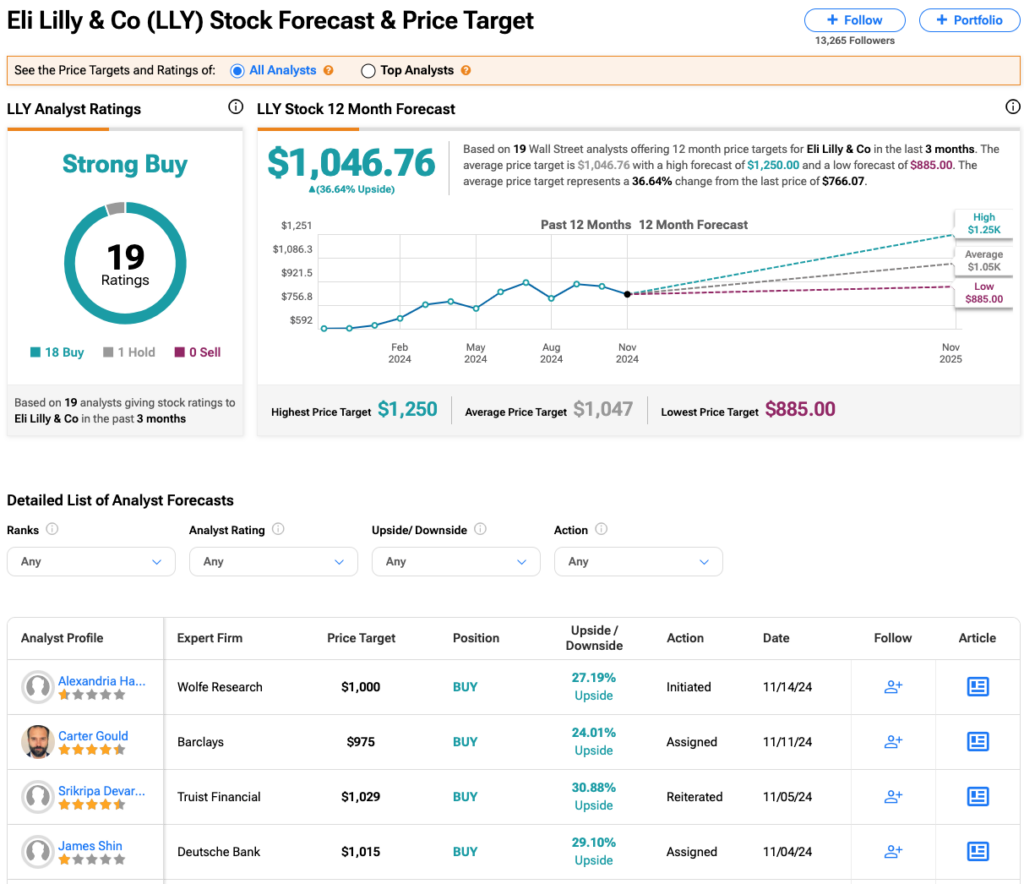

Wall Street doesn’t seem worried about how this may impact Eli Lilly. Analysts have a Strong Buy consensus rating on LLY stock based on 18 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 34% rally in its share price over the past year, the average LLY price target of $1,047 per share implies 37% upside potential.