Shares of Elanco Animal Health (NYSE:ELAN) are ticking lower today after the animal health company reported mixed fourth-quarter numbers. Revenue increased by 5.3% year-over-year to $1.04 billion, exceeding expectations by roughly $35 million. EPS of $0.08, on the other hand, missed the cut by $0.02.

The uptick in the company’s top line was driven by its Farm Animal business and pricing gains. The quarter was marked by robust double-digit revenue gains across Elanco’s Farm Animal, Cattle, and Poultry segments. Its Pet Health and Swine businesses, on the other hand, witnessed low-single-digit contractions. Additionally, its Q4 adjusted EBITDA saw an adverse impact from the substantial devaluation of the Argentinian Peso.

For Fiscal Year 2024, Elanco expects revenue in the range of $4,450 million to $4,540 million. EPS for the year is seen landing between $0.87 and $0.95. For the upcoming quarter, Elanco estimates an EPS of $0.25 to $0.28 on revenues of $1,160 million to $1,185 million.

Additionally, Elanco is undertaking strategic restructuring actions to drive cost savings. The move is estimated to impact nearly 420 positions and result in annualized savings in the range of $30 million to $35 million.

Is ELAN a Good Stock to Buy?

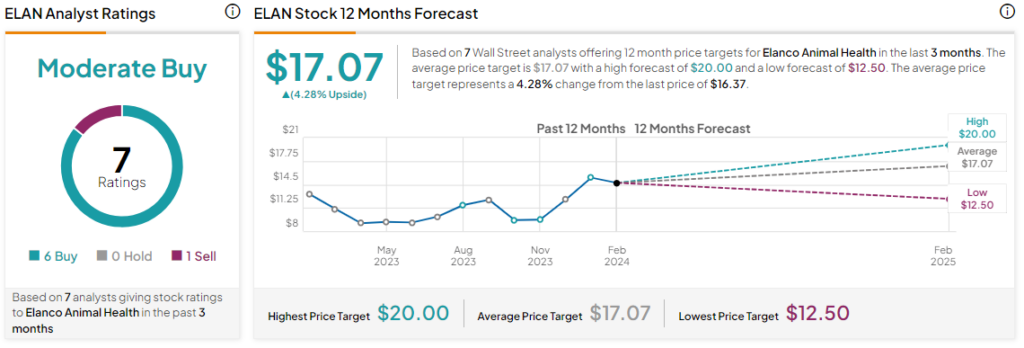

Today’s price decline comes after a nearly 36% jump in Elanco’s stock price over the past three months. Overall, the Street has a Moderate Buy consensus rating on Elanco, and the average ELAN price target of $17.07 implies a modest 4.3% potential upside in the stock. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure