Online health insurance services provider eHealth Inc. (EHTH) delivered disappointing third-quarter results, with earnings and revenue both missing expectations by a large margin, sending shares down 25.6% to close at $30.06 on November 8.

The company also revised its FY21 outlook amid weak membership and lower telesales conversion rates.

Weaker-Than-Expected Results

The company reported a quarterly loss of $1.78 per share, significantly wider than analysts’ estimated loss of $1.02 per share, and the loss of 36 cents per share in the same quarter last year.

The heavy loss in Q3 was attributed to lower revenue, increased marketing and advertising expenses, coupled with higher customer care and enrollment expenses, in preparation for the annual enrollment period.

Moreover, revenue declined 32% year-over-year to $63.91 million, missing Street estimates of $93.04 million. During the quarter, eHealth’s Commission revenue, a major revenue source, fell significantly due to a 15% year-over-year decrease in the number of approved members and lower telesales conversion rate.

On a segmental basis, Medicare revenue declined 34%, while Individual, Family and Small Business revenue decreased 27% against the same quarter last year.

See Analysts’ Top Stocks on TipRanks >>

Management Comments

Commenting on the results, Francis Soistman, CEO of eHealth, said, “Our digital platform provides eHealth with a strong competitive advantage as seniors’ and consumers of all ages continue to adopt the internet for research, social interaction, shopping, and other daily needs including healthcare, a trend that has been accelerated by the global COVID pandemic.”

Soistman concluded, “While the company has faced some setbacks over the past year, I am confident in our ability to navigate these short-term challenges under new leadership, leveraging my healthcare and Medicare industry expertise with a particular focus on driving operational efficiency and excellence.”

Slashed Guidance

Based on the current economic environment and slowdown in business, eHealth has lowered its full-year fiscal 2021 guidance. The company now forecasts revenue to be in the range of $535 million to $575 million, much lower than the consensus estimate of $690.74 million. Additionally, the FY21 loss is expected to be between $0.45 per share and $1.13 per share, against the consensus estimate of a profit of $2.91 per share.

Analysts’ View

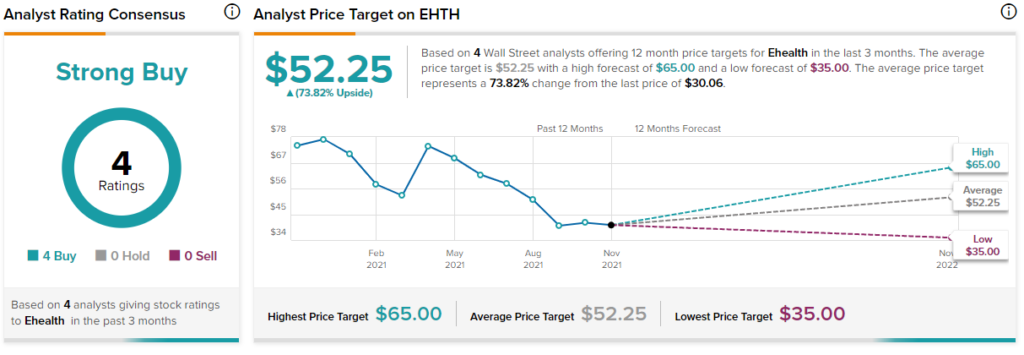

Responding to eHealth’s poor Q3 performance, Cantor Fitzgerald analyst Steven Halper lowered the price target on the stock to $50 (66.33% upside potential) from $80, while maintaining a Buy rating.

However, with 4 unanimous Buys, the stock has a Strong Buy consensus rating, and the average eHealth price target of $52.25 implies 73.82% upside potential to current levels. Shares have lost 59.3% over the past year.

Related News:

Twitter Poll Urges Elon Musk to Sell 10% of Tesla Stake

DraftKings Misses Q3 Expectations; Shares Fall

Kimco Outperforms in Q3; Shares Hit All-Time High