Shares of Ecolab dropped 4.1% on Tuesday, after the company, which provides water, hygiene, and energy technologies and services, reported lower-than-expected 4Q results, primarily due to the COVID-19 pandemic.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Ecolab’s (ECL) 4Q earnings of $1.23 per share missed analysts’ estimates of $1.25 and declined 15% year-over-year. The company said, “The adjusted EPS decrease reflects COVID-19 related volume declines, unfavorable business mix and investments in the business which together more than offset cost savings, favorable pricing and lower variable compensation.” However, earnings improved sequentially.

The company’s 4Q revenues declined 6% to $3.07 billion and lagged the Street’s estimates of $3.11 billion. Ecolab’s healthcare & life sciences segment saw 23% revenue growth in 4Q, while its industrial, institutional & specialty and other segment declined year-over-year.

Ecolab CEO Christophe Beck said, “Our underlying business continued its sequential improvement as sales trends remained stable and operating income further improved, driven by new business and customer penetration gains, along with continued pricing and lower costs.”

Beck expects COVID-19 to continue to impact its end markets in 2021. Though he expects a recovery in the global end markets from the second quarter of 2021, he still believes that “it will take several quarters to fully realize a new normal.”

However, he added that “our strengthened business will deliver full year 2021 earnings above 2019 results from continuing operations, with the first quarter year-on-year percentage decline showing modest sequential improvement from the fourth quarter and the remaining quarters of 2021 showing strong year-on-year growth.” (See Ecolab stock analysis on TipRanks).

Following the earnings results, Oppenheimer analyst Scott Schneeberger maintained a Hold rating on the stock. The analyst said, “Ecolab’s 4Q20 adjusted EPS from continuing operations of $1.23 (-15% year/year) compared to our estimate/consensus of $1.26/$1.25, respectively.”

Overall, the rest of the Street has a cautiously optimistic outlook on the stock with a Moderate Buy consensus rating based on 3 Buys, 4 Holds, and 1 Sell. The average analyst price target of $224.33 implies upside potential of about 6.4% to current levels. Shares have gained 2.7% over the past year.

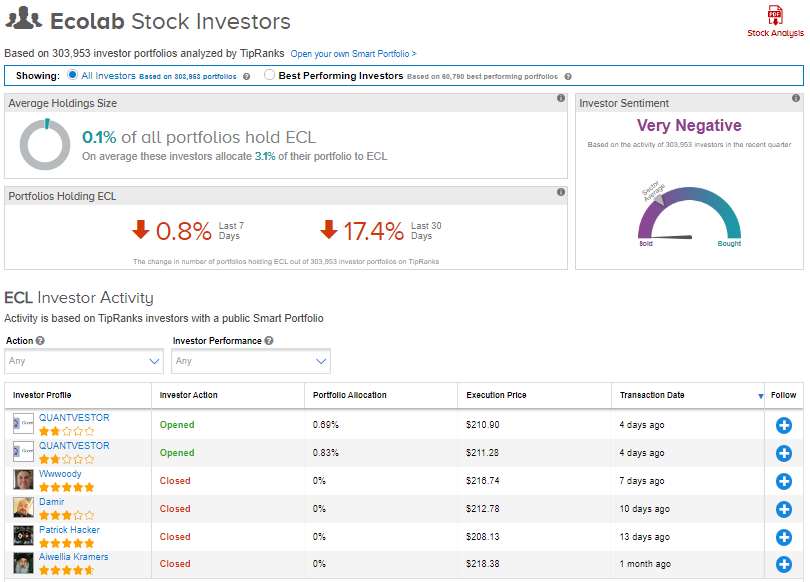

The TipRanks’ stock investors tool shows that investors currently have a Very Negative stance on ECL.

Related News:

RingCentral’s 2021 Guidance Tops Estimates After 4Q Beat

IPG Photonics Posts Profit In Fourth Quarter; Shares Gain

Denny’s 4Q Revenues Miss Estimates Due To COVID-19 Pandemic