eBay issued a statement on Feb. 16 regarding the UK Competition and Markets Authority’s (CMA) concerns about Adevinta’s $9.2 billion acquisition of the e-commerce giant’s Classifieds Group. The CMA has concerns that the proposed transaction could reduce competition in the UK, following a Phase 1 review.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

eBay (EBAY) stated, “eBay and Adevinta now have the opportunity to propose potential remedies to avoid the transaction being referred to further investigation. While eBay and Adevinta do not agree with the CMA’s reasoning, they will work constructively with the CMA and are confident in finding a suitable resolution.”

The company said that along with Adevinta, it will propose legally binding solutions to resolve CMA’s concerns before the deadline of Feb. 23. The CMA will then have five working days to either accept the solutions or open an in-depth investigation. eBay expects to provide the next update in early March.

In July last year, eBay announced that Adevinta, an online classifieds specialist, will buy its classified business for $9.2 billion. As part of the transaction, eBay will receive cash of $2.5 billion and 540 million shares of Adevinta that would result in eBay acquiring a 44% equity stake in the company. (See eBay stock analysis on TipRanks)

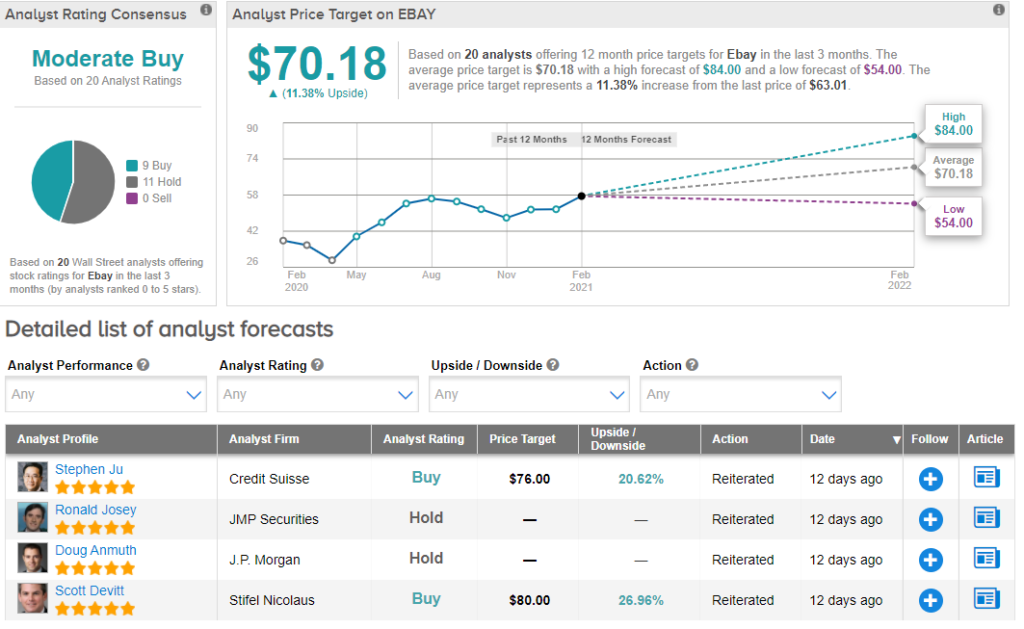

Earlier this month, Stifel Nicolaus analyst Scott Devitt reiterated a Buy rating and a price target of $80 on the stock. Devitt wrote in a note to investors, “In our view, improvements in the core marketplace business, focused on enhancements to the buyer/seller experience and development of new verticals are underappreciated by the market, as investors remain cautious approaching difficult comps beginning in 2Q.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 9 analysts recommending a Buy and 11 analysts suggesting a Hold. The average analyst price target of $70.18 implies 11.4% upside potential to current levels.

Related News:

BHP Group Expects Strong Steel Demand From China To Drive 2H21

Google Clinches Content Licensing Deal With Australia’s Seven West

ACI Teams Up With Auriga For Self-Service Banking Platform; Street Says Buy