EBay Inc. (EBAY) is reportedly in advanced talks to sell its classified-ads business to Norway’s online market place Adevinta ASA, as the auction platform seeks to refocus on its core business.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

According to the Wall Street Journal, a cash-and-stock deal could be announced as soon as today assuming the talks don’t fall apart. The EBay unit was expected to sell for roughly $8 billion or more, according to the report. Trading in Adevinta shares in Oslo were halted amid the report.

The news comes after Bloomberg reported over the weekend that the e-commerce platform prefers to keep a stake in the classified advertising unit it’s selling, reducing the odds that Prosus NV will win the hotly-contested bidding. A deal with Adevinta would leave EBay with a significant stake in the combined business.

If Adevinta’s bid succeeds it would also have beaten out that of a private-equity consortium backed by Blackstone Group Inc. (BX), Permira and Hellman & Friedman, which also offered to let EBay keep a minority stake.

Ebay has been seeking to sell the classifieds unit since around February, in response to activist investors that want it to focus on its main online marketplace. The unit is one of its last remaining non-core businesses after the company sold its StubHub ticketing division last year.

Ebay shares have been on a phenomenal run rallying 61% this year as more people ordered online due to the stay-at-home orders in place to contain the coronavirus pandemic.

Five-star analyst Scott Devitt at Stifel Nicolaus last week raised the price target on the stock to $66 (14% upside potential) from $52, to reflect a higher valuation of the classifieds business in his sum-of-the parts valuation.

“Recent news reports are suggesting bids in the $8B range (ahead of our $5.6B prior estimate),” Devitt, who maintained a Buy rating on the stock, wrote in a note to investors. “The company may provide an update on the classifieds business before the earnings release [on July 28] which may be positive for the stock leading into earnings.”

“EBay continues to benefit from favorable trends in e-commerce which we believe may have more legs than currently reflected in estimates,” the analyst added.

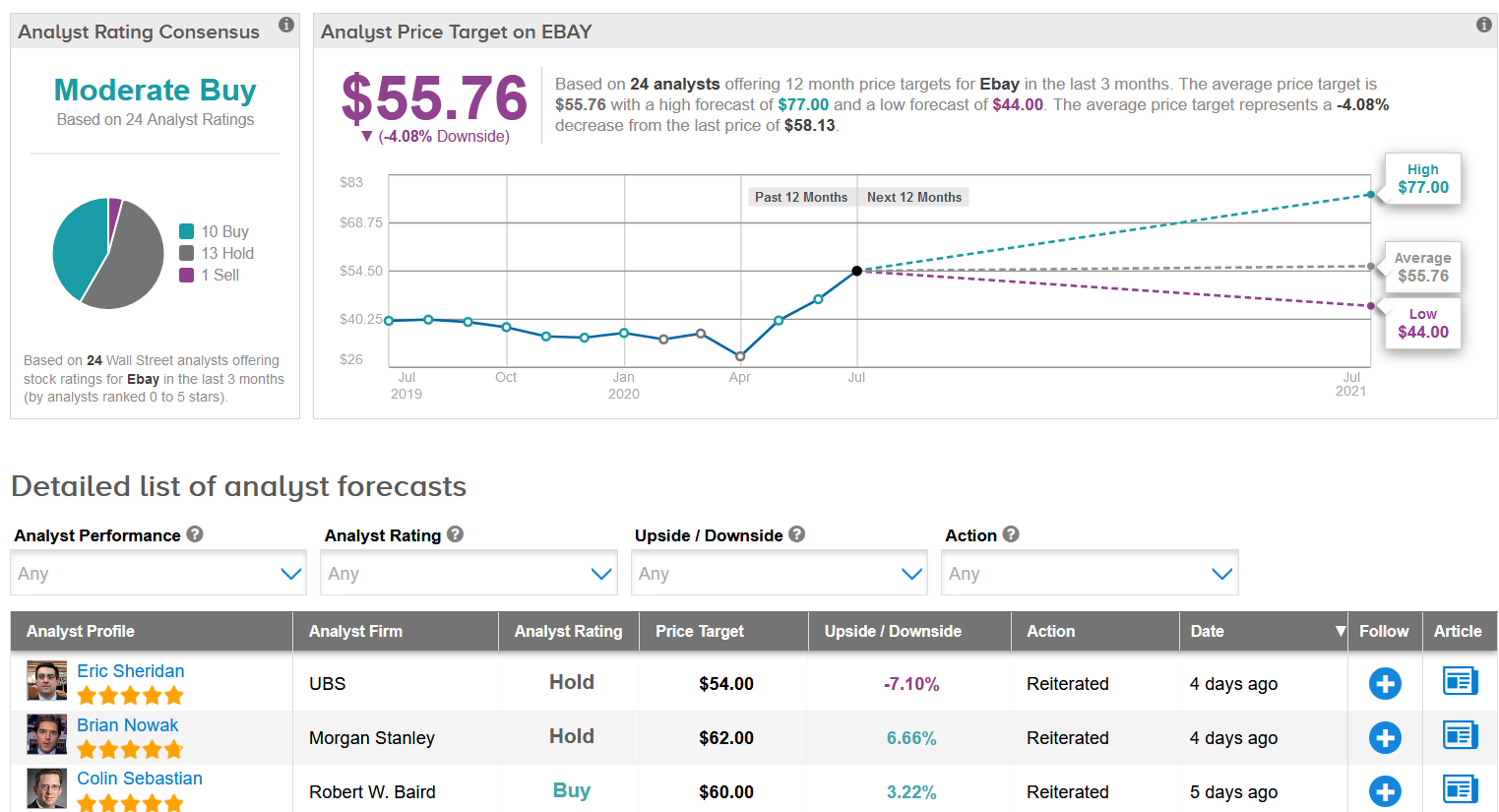

The rest of the Wall Street community has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus shows 10 Buys versus 13 Holds and 1 Sell. Meanwhile, the $55.76 average price target now implies 4% downside potential over the next 12 months. (See EBAY stock analysis on TipRanks).

Related News:

EBay Seeks To Retain Stake in Classifieds Unit, Challenging Prosus Bid; Top Analyst Raises PT

Alibaba’s CEO Sets Out Ambitious Goals; Sees 2B Customers By 2036

Amazon Delays Prime Day- This Time Until October