Global commerce company eBay (EBAY) reported better-than-expected results for the second quarter despite macro headwinds. The continued momentum in advertising sales and higher gross merchandise volume (GMV) supported the company’s performance during the quarter.

It should be noted that the company has an impressive earnings surprise history, as it surpassed estimates in each quarter since October 2020 (for a thorough assessment of EBAY stock, go to TipRanks’ Stock Analysis page).

EBAY: Q2 Financial Highlights

The company delivered revenue of $2.57 billion in Q2, up 1% year-over-year. This came higher than the Street’s estimate of $2.53 billion. Further, eBay posted adjusted earnings of $1.18 per share, up by 15% year-over-year and above the analysts’ expectations of $1.13.

eBay’s total advertising revenue grew 8% to $398 million. Moreover, the company’s GMV in the second quarter stood at $18.4 billion, up 1% from the year-ago quarter. EBAY defines GMV as the total value of all paid user transactions on its platforms during the period, including shipping fees and taxes.

Q3 Outlook

The company expects to deliver GMV between $17.8 and $18.2 billion in Q3. Additionally, eBay expects revenues to be in the range of $2.50 billion to 2.56 billion, compared to the analysts’ forecast of $2.54 billion.

Furthermore, EBAY expects adjusted EPS to be between $1.15 and $1.20 for the third quarter, reflecting a year-over-year growth of 12% to 17%. Also, the guided figure compares favorably with the consensus estimate of $1.13.

Is eBay a Good Stock to Buy?

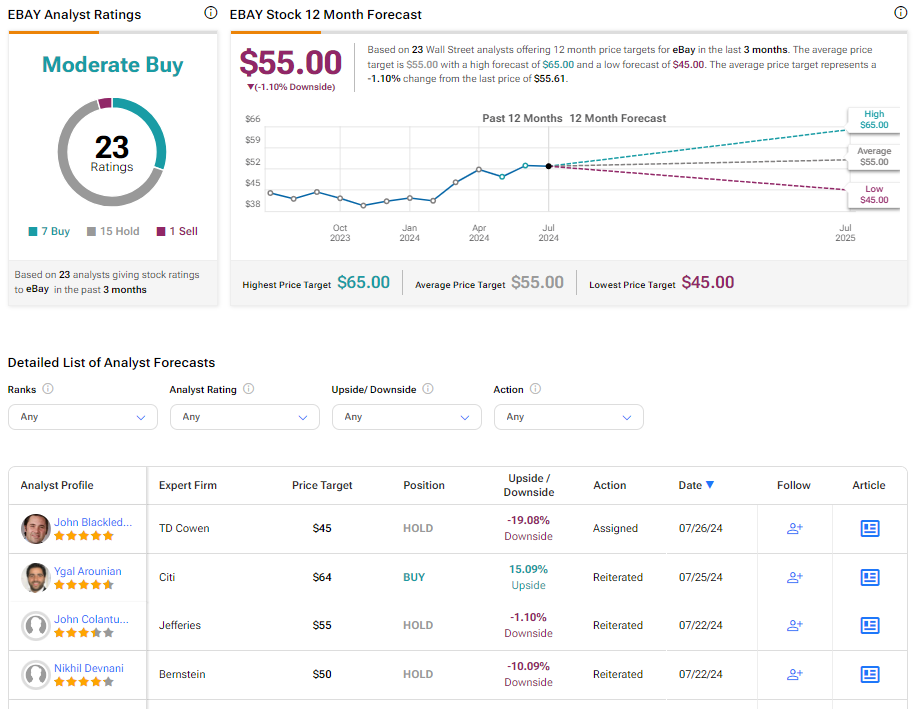

Analysts remain cautiously optimistic about EBAY stock, with a Moderate Buy consensus rating based on seven Buys, 15 Holds, and one Sell. Year-to-date, eBay has increased about 29%, and the analysts’ average price target on eBay stock of $55 per share implies 1.1% downside potential.

It should be noted that analysts’ views on EBAY stock could see changes following the earnings report.