Shares of multinational power management firm Eaton (ETN) gained over 4% to close at $162.81 on Tuesday after the company reported solid financial results for the second quarter of 2021. Eaton offers wiring devices, industrial and electrical components, lighting, fire detection and residential products.

The company is also engaged in the production of components for commercial vehicles like power train systems, as well as pneumatic systems, hydraulics and aerospace fuel for commercial and military use.

Adjusted earnings per share (EPS) almost doubled year-over-year to $1.72, beating the Street’s estimate of $1.55. Quarterly sales grew 35% to $5.2 billion, exceeding analysts’ expectations of $4.91 billion. (See Eaton stock chart on TipRanks)

Sales from the Electrical Americas segment rose 24% year-over-year to $1.8 billion; Electrical Global segment’s sales were up 28% at $1.4 billion; Aerospace segment sales surged 36% to $625 million; sales of Vehicle segment climbed 106% to $675 million; and eMobility segment sales increased 57% to $88 million.

The Chairman and CEO of Eaton, Craig Arnold, said, “Driven by strong second-quarter performance and anticipated higher organic sales for the remainder of the year, we now expect 2021 adjusted EPS to be between $6.58 and $6.88, up 37% at the midpoint over 2020. Additionally, we expect 2021 full-year adjusted operating cash flow to be between $2.6 billion and $2.8 billion, up $200 million at the midpoint over our previous guidance. Finally, for the third quarter of 2021, we anticipate adjusted earnings per share to be between $1.72 and $1.82.”

Following the announcement of the second-quarter results, Robert W. Baird analyst Mircea Dobre reiterated a Hold rating on the stock with a price target of $157 (3.6% downside potential).

The analyst said, “Orders accelerated in Electrical segments during the quarter to drive record backlog, Aero starting to improve as well, Vehicle performing very well in spite of supply chain disruptions.”

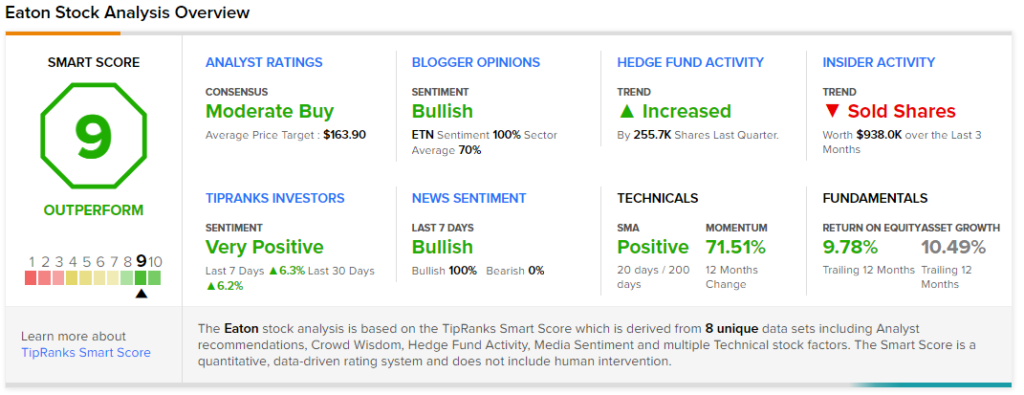

Overall, the stock has a Moderate Buy consensus based on 6 Buys and 4 Holds. The average Eaton price target of $163.90 implies shares are fully valued at current levels. The stock has gained 72% over the past year.

According to TipRanks’ Smart Score rating system, Eaton scores a 9 out of 10, suggesting that the stock is likely to outperform market averages.

Related News:

Realty Income Posts Mixed Q2 Results

PepsiCo Restructuring Juice Businesses

Transocean Misses Q2 Expectations; Shares Drop