Global specialty materials firm Eastman Chemical (EMN) has posted record revenue and adjusted earnings per share (EPS) for the second quarter of 2021, which surpassed analysts’ expectations. The Tennessee-based company manufactures a range of fibers, chemicals and advanced materials for daily use.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Eastman reported adjusted EPS of $2.46, up from last year’s $0.85, beating the Street’s estimate of $2.30. (See Eastman stock chart on TipRanks)

Quarterly sales revenue grew 38% year-over-year to $2.65 billion, exceeding analysts’ expectations of $2.4 billion. The rise was driven by growth across all business segments due to a strong recovery in demand across key markets.

Additives & Functional Products segment’s sales revenue increased 35% year-over-year; sales revenue of Advanced Materials segment surged 36%; Chemical Intermediates segment’s sales revenue jumped 60%; and sales revenue of Fibers segment climbed 6%.

The Board Chair and CEO of Eastman, Mark Costa, said, “With strong first-half results and continued momentum into the second half, we now expect 2021 adjusted EPS to be between $8.80 and $9.20. We are also increasing our expectation for free cash flow to greater than $1.1 billion, which would be the fifth consecutive year of free cash flow above $1 billion.”

Last month, Wells Fargo analyst Michael Sison assigned a Buy rating to the stock and raised the price target from $130 to $142 (27% upside potential). In a research note to investors, the analyst said that he expected the company’s Chemical Intermediates and Advanced Materials segments to drive upside in the short term.

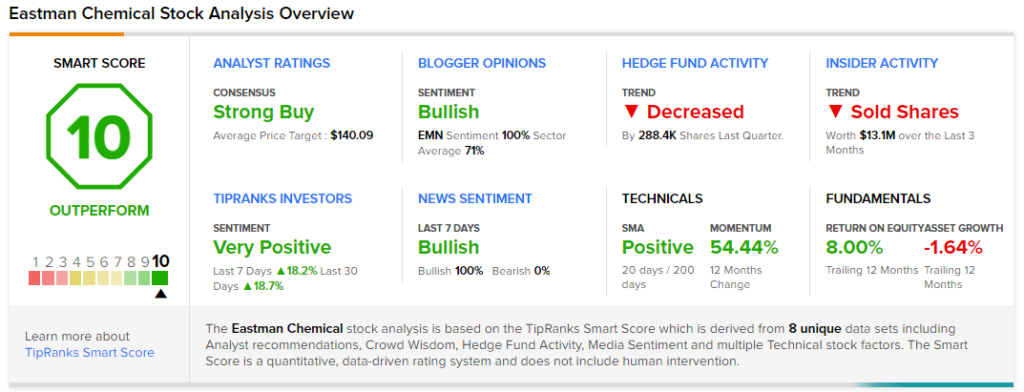

Overall, the stock has a Strong Buy consensus based on 7 Buys and 1 Hold. The average Eastman Chemical price target of $142.63 implies 27.5% upside potential. Shares of the company have gained 48.8% over the past year.

According to TipRanks’ Smart Score rating system, Eastman scores a “Perfect 10,” suggesting that the stock is likely to outperform market averages.

Related News:

Grainger Misses Q2 Earnings Expectations, Mutes Guidance

FDA Approves Johnson & Johnson IV Drug

Imperial Oil Delivers Strong Q2 Revenues & Production