Eagle Bulk Shipping Inc. (EGLE) has revealed its plans to initiate a common stock dividend and a $50 million share repurchase program, along with the closing of a $400 million comprehensive refinancing.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Eagle Bulk engages in the ocean transportation of a broad range of dry bulk cargoes worldwide through the ownership, charter and operation of dry bulk vessels. Shares of the company declined 4% on Monday. (See Eagle Bulk stock chart on TipRanks)

The board of directors have authorized the distribution of quarterly cash dividends equal to a minimum of 30% of net income but not less than $0.10 per share. Notably, the first dividend will be payable in November based on the company’s third-quarter results. Furthermore, the share repurchase program will be at the discretion of the company.

The CEO of Eagle Bulk, Gary Vogel, said, “Today’s announcement is the culmination of a five-year transformation of Eagle that has resulted in a substantially larger and more efficient fleet, as well as a stronger balance sheet.”

Following the news, Noble Financial analyst Poe Fratt maintained a Buy rating on Eagle Bulk and raised the price target to $84 from $65. The new price target implies 68.3% upside potential from current level.

Fratt noted, “Given improving cash flow, the global refinancing and the move up in asset values that limits additional acquisitions, we expect a regular and/or special dividend to be announced by year-end 2021.”

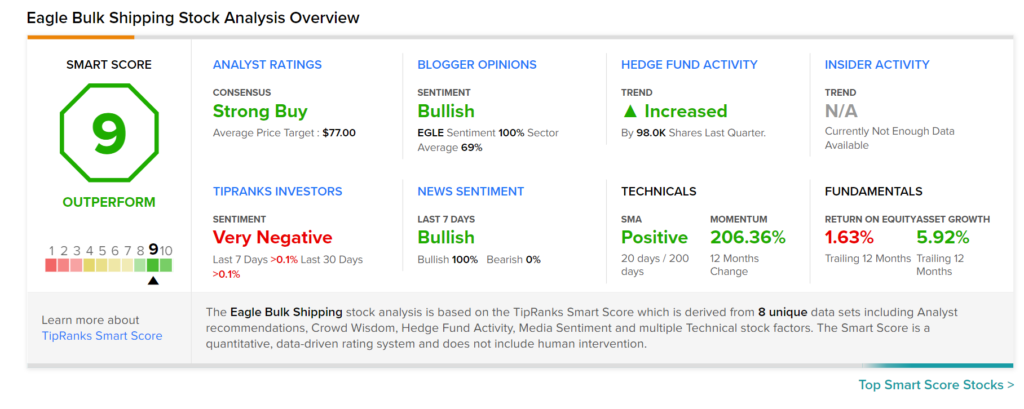

Consensus among analysts is a Strong Buy based on 3 unanimous Buys. The average Eagle Bulk price target stands at $77 and implies upside potential of 54.3%.

EGLE scores a 9 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to outperform market averages.

Related News:

Accenture Completes Buyout of umlaut; Analysts Remain Bullish

Life Storage Cheers Shareholders with 16% Dividend Hike

Roper Strikes Deal to Divest TransCore Business