DuPont (NYSE:DD) shares are trending lower today after the technology-based materials and solutions provider announced third-quarter results, with revenue declining by 8% year-over-year to $3.1 billion. The figure came in a tad lower than the Street’s expectations by $92 million. EPS of $0.92, on the other hand, outpaced estimates by $0.08.

The company is witnessing volume challenges owing to channel inventory destocking and demand softness in the Chinese market. Further, its operating EBITDA declined to $775 million from $856 million in the comparable year-ago period. Importantly, the company witnessed organic sales contraction across its key geographies, including Asia Pacific, EMEA, the U.S., and Canada.

Looking ahead to Fiscal year 2023, DuPont expects to generate adjusted EPS of $3.45 on revenue of $12.17 billion. The company is also planning restructuring actions to achieve cost optimization.

Separately, DuPont announced that it expects to complete the sale of a nearly 80% stake in the Delrin acetal homopolymer business to TJC in a $1.8 billion transaction. The company expects to receive $1.28 billion in pre-tax proceeds from the deal and upon its closure will retain a nearly 20% stake in Delrin.

Is DD Stock a Good Investment?

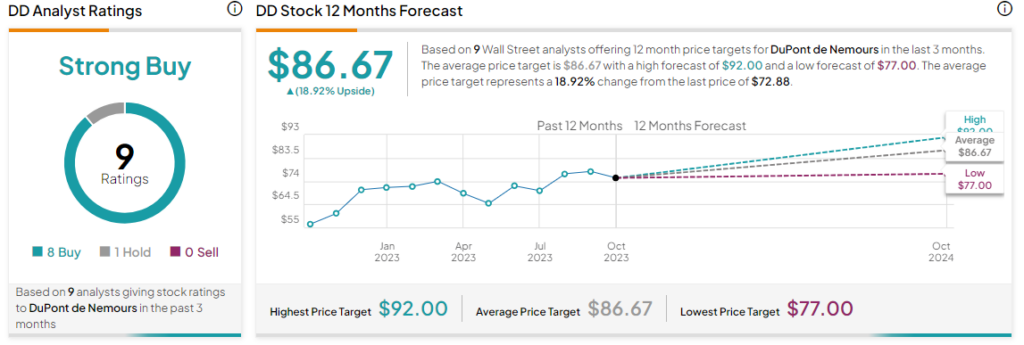

Overall, the Street has a Strong Buy consensus rating on DuPont. The average DD price target of $86.67 implies a nearly 19% potential upside. That’s on top of a nearly 27% rise in DuPont shares over the past year.

Read full Disclosure