Duck Creek Technologies (NASDAQ: DCT) reported stronger-than-expected fiscal Q2 results, topping both earnings and revenue estimates driven by robust performance across all segments.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

However, despite Q2 beat, shares of the software as a service (SaaS) provider to the P&C insurance industry dropped 12.3% during the extended trading session on March 31.

Investors were dissuaded by the lower-than-expected FY2022 guidance updated by the company.

Q4 Beat

Adjusted earnings of $0.04 per share quadrupled year-over-year and beat analysts’ expectations of $0.01 per share. The company reported earnings of $0.01 per share for the prior-year period.

Furthermore, revenues jumped 22% year-over-year to $76.4 million and exceeded consensus estimates of $72.75 million. The increase in revenues reflects a surge in revenues across all the segments along with SaaS Annual Recurring Revenue (ARR), which increased 28%.

FY2022 Outlook

Based on current expectations, Duck Creek Technologies, management updated financial guidance for FY2022.

DCT now forecasts FY22 revenues to be in the range of $301 million to $305 million, versus the consensus estimate of $302.05 million. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) is likely to range between $20.5 million to $22.5 million.

For the fiscal third quarter, revenues are projected to be in the range of $71 to $73 million, versus the consensus estimate of $76.06 million. Adjusted EBITDA are likely to range between $0.5 million to $1.5 million.

CEO Comments

Duck Creek CEO, Michael Jackowski, commented, “As we look ahead, we are focused on working closely with our customers to help best position their business in these evolving market and macro environments. We are incredibly confident in Duck Creek’s ability to generate strong growth and increased profitability over time.”

Wall Street’s Take

Following the Q2 beat, JMP Securities analyst Joe Goodwin reiterated a Buy rating on Duck Creek Technologies with a price target of $27 (22.1% upside potential).

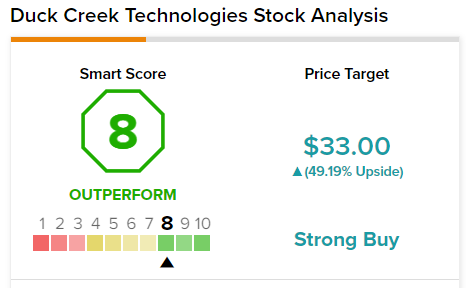

Overall, the stock has a Strong Buy consensus rating based on eight Buys and one Hold. The average Duck Creek Technologies price forecast of $33 implies 49.19% upside potential from current levels.

TipRanks’ Smart Score

VZ scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Jefferies Beats Q1 Expectations; Shares Gain 3.7%

Lightning eMotors Slips 11.8% on Revenues Miss & Dim Outlook

Science Applications Delivers Upbeat Q4 Results; Shares Gain 4.2%