Darden Restaurants (NYSE:DRI) reported mixed results in the Fiscal fourth quarter, with adjusted diluted net earnings of $2.65 per share, up by 2.7% year-over-year, beating Street estimates of $2.61 per share. The company, which owns restaurant brands like Olive Garden and LongHorn Steakhouse, generated total sales of $3 billion, an increase of 6.8% year-over-year, surpassing consensus estimates of $2.97 billion.

DRI’s Comparable Sales Remained Flat in Q4

Overall, Darden’s same-store sales remained flat for the quarter, dragged down by Olive Garden’s weaker-than-expected performance. Olive Garden’s sales fell by 1.5% in Q4 compared to analysts’ expectations of flat same-store sales.

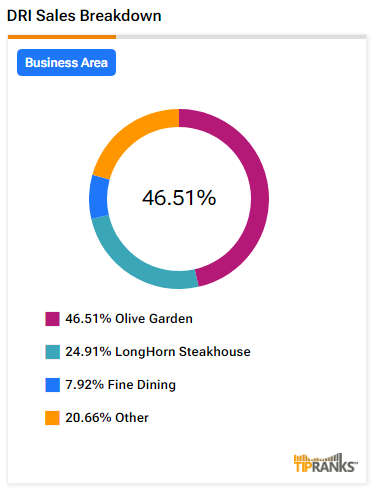

Despite this, Olive Garden continued to be the biggest contributor to Darden’s sales, accounting for more than 40% of the company’s total sales of $3 billion. Olive Garden posted sales of $1.27 billion in Fiscal Q4.

DRI’s Dividends and Stock Buybacks

Darden’s Board of Directors declared a quarterly cash dividend of $1.40 per share, payable on August 1 to shareholders of record at the close of business on July 10, 2024. This is a 6.9% increase from the third quarter of FY24.

During the Fiscal fourth quarter, the company repurchased approximately 0.6 million shares of its common stock for a total of around $97.3 million. At the end of Q4, Darden had approximately $915 million remaining under the current $1 billion authorization for stock buybacks.

Darden’s FY25 Outlook

In FY25, Darden has projected total sales in the range of $11.8 billion to $11.9 billion, with same-restaurant sales likely to grow between 1% and 2%. The company expects diluted net earnings from continuing operations to be in the range of $9.40 to $9.60 per share.

Is DRI a Good Stock to Buy?

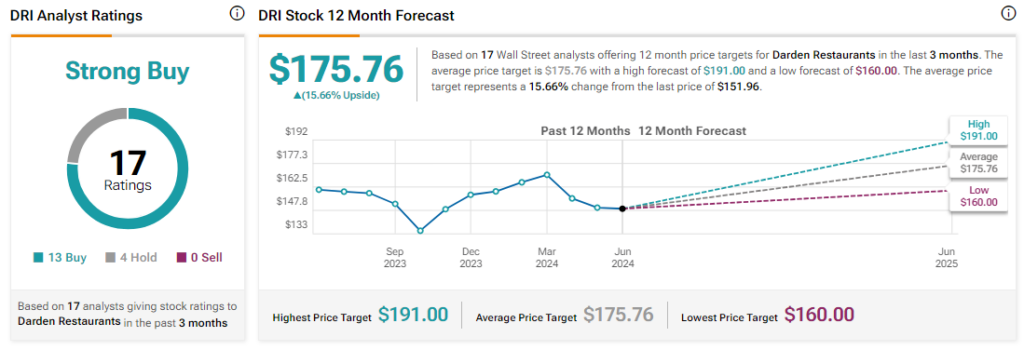

Analysts remain bullish about DRI stock, with a Strong Buy consensus rating based on 13 Buys and four Holds. Year-to-date, DRI has declined by around 6%, and the average DRI price target of $175.76 implies an upside potential of 15.6% from current levels. These analyst ratings are likely to change following DRI’s Fiscal Q4 results today.