Digital sports entertainment and gaming company DraftKings Inc. (DKNG) recently revealed that it has partnered with OneTeam Partners, the group licensing partner of the NFL Players Association (NFLPA), to launch gamified NFT (non-fungible token) collections that will debut on DraftKings Marketplace during the 2022-2023 NFL season.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Following the news, shares of the company rose 1.9% to close at $31.31 in Tuesday’s extended trading session.

Strategic Impact

With this partnership, DraftKings will have licensing rights for active NFL players, including the authentic use of name, image and likeness. The partnership also adds to the existing relationship between NFL and DraftKings that include being an Official Daily Fantasy and Sports Betting Partner of the league.

Among the features that are expected to mark this collaboration include the ability for customers to use these collectibles in games against others on the platform, along with separate buying and selling features.

The gamified NFTs will be powered by Polygon.

Management Commentary

The SVP of Product Operations for DraftKings Marketplace, Beth Beiriger said, “The future of fandom is unfolding in front of us, and few organizations beyond DraftKings are as equipped to capitalize on the increasing intersection between sports and NFTs that will be cornerstones of engagement and entertainment within Web3. We will continuously adapt, innovate and seek progressive collaborators like the NFLPA and OneTeam to reach early adopters among fanbases and ultimately introduce these next-generation products to the masses.”

See Top Smart Score Stocks on TipRanks >>

Price Target

Recently, Bank of America Securities analyst Shaun Kelley reiterated a Hold rating on the stock with a price target of $45, which implies upside potential of 43.9% from current levels.

The Street community is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 11 Buys, 7 Holds and 1 Sell. The DraftKings stock forecast of $61.06 implies that the stock has upside potential of 95.3% from current levels. Shares have declined 38.5% over the past year.

Website Traffic

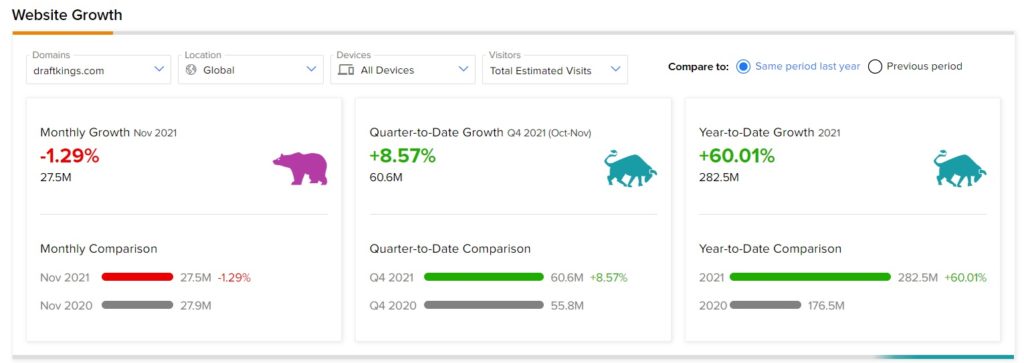

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings, the world’s biggest website usage monitoring service, offers insight into DraftKings’ performance this quarter.

According to the tool, the DraftKings website recorded a 1.29% monthly fall in global visits in November, compared to the same period last year. Yet, year-to-date, draftkings.com traffic has grown 60.01%, compared to the previous year.

Related News:

TELUS Partners with IBM to Deliver 5G Across Canada

Astra to Launch for NASA in January

Accenture Invests in Interos; Street Says Buy