DraftKings has entered into an agreement with UFC, a mixed martial arts organization, to be its first official sportsbook and daily fantasy partner in the US and Canada.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

As part of the agreement, DraftKings (DKNG), an online sports betting and entertainment company will offer activations, in-broadcast odds integrations, in-game promotions and UFC branding across its betting and daily fantasy products.

DraftKings will also have access to official UFC logos and marks and will provide UFC fans access to free-to-play UFC games, enhanced prop bets and other sportsbook opportunities on a weekly basis. The company will also become a presenting partner of UFC’s Fight Clock, the organization’s proprietary time-keeping system in combat sports.

Shares of DKNG were down 3.8% in after-market trading on March 4.

DraftKings CEO Jason Robins said, “Combat sports, and UFC in particular, have scaled significantly across both our sportsbook and daily fantasy verticals, evolving from a niche offering to a high-demand category that we believe will only grow further as we innovate. While DraftKings and UFC have previously collaborated on specific events, we are proud to become official partners and explore even more impactful integrations that prioritize the fan experience.”

Earlier this week, DKNG inked a strategic agreement with Dish Network (DISH) on March 3 to integrate the DraftKings app on Dish TV’s Hopper platform. The agreement also includes the integration of DKNG’s sportsbook and fantasy experience with Dish’s Sling TV and Boost Mobile at a later stage. (See DraftKings stock analysis on TipRanks)

Last month, DKNG raised its FY21 revenue guidance from a range of $750 million to $850 million to a range of $900 million to $1 billion, indicating year-on-year growth of between 40% to 55%. The guidance update comes after the launch of online legal sports betting in the states of Michigan and Virginia and assumes that all professional and college sports events will take place as announced.

On March 1, Rosenblatt Securities analyst Bernie McTernan reiterated a Buy and a price target of $72 on the stock.

“DKNG increased their guidance for ’21E to $900M-$1B from $750M-$850M, a 19% increase at the midpoint driven by strong results in 4Q and launches in MI and VA. VisibleAlpha consensus is $882M for ’21E and the midpoint represents 8% upside,” McTernan wrote in a note to investors.

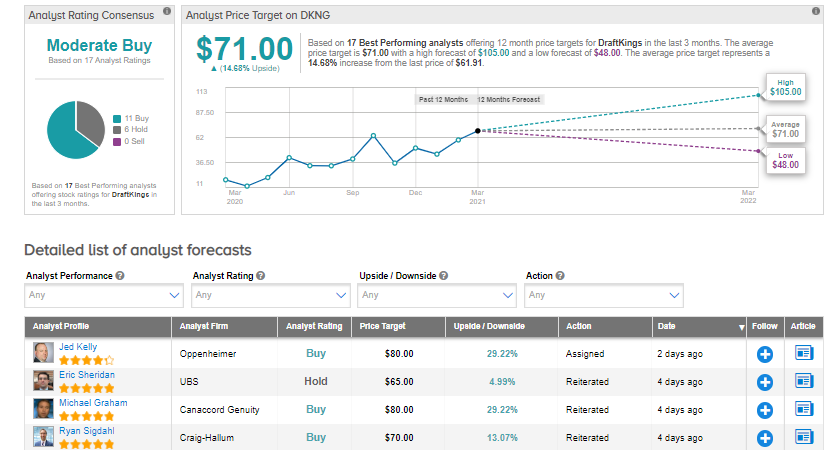

The rest of the Street is cautiously optimistic on the stock with a Moderate Buy consensus rating based on 11 Buys and 6 Holds. The average analyst price target of $71 implies around 14.7% upside potential to current levels. That’s after shares of DKNG ballooned over 30% so far this year

Related News:

Snowflake’s Loss Doubles In 4Q; Shares Drop 3.8%

Splunk’s 4Q Results Top Wall Street Estimates; Shares Jump 5.1%

Zynga Snaps Up Echtra Games; Street Says Buy