Shares of online sports betting and gaming platform DraftKings Inc. (NASDAQ: DKNG) slumped 21.6%, marking a new all-year low of $17.23, after reporting its fourth-quarter fiscal 2021 results.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Backed by strong demand for both its Sportsbook and iGaming product offerings, DKNG’s revenue beat expectations. However, its guidance for a huge FY22 loss pushed the shares down to close at $17.29 on February 18. DKNG shares have lost 67.1% over the past year.

Meanwhile, aided by robust player retention, acquisition, and cross-selling, DKNG also reported positive numbers for its key metrics in Q4. The company’s Monthly Unique Payers (MUPs) grew 32% and the Average Revenue Per Monthly Unique Payer leaped 19% year-over-year to $77.

As of date, DraftKings is live with mobile sports betting in 17 states (36% of U.S. population) and live with iGaming in 5 states (11% of U.S. population). Further, as more and more states introduce the legalization of sports betting and iGaming, it will further add to DraftKings’ potential market expansion opportunities.

Q4 & FY21 Results

DraftKings’ Q4 revenue advanced 47% year-over-year to $473.3 million and meaningfully outpaced Street estimates of $445.3 million. The number also beat its own guidance provided during the Q3 results by 8%.

In FY21, DraftKings’ revenue more than doubled to $1.29 billion and its diluted loss per share stood at $3.78 per share, lower than diluted loss of $4.03 per share in FY20.

CEO Comments

Pleased with the company’s performance, co-founder, CEO, and Chairman of the Board of DraftKings, Jason Robins, said, “Our excellent quarter capped off a year in which five of our states were Contribution Profit positive, further demonstrating the effectiveness of our state playbook and supporting our positive view of the industry’s TAM. We enter 2022 positioned to grow our market share, further optimize our user experience and continue to strengthen our multi-product suite of offerings.”

Increasing Outlook

For the full year fiscal 2022, DKNG is raising its revenue guidance to fall between $1.85 and $2.0 billion, in-line with the consensus estimate of $1.9 billion. Earlier, the company had guided for FY22 revenue to be between $1.7 billion and $1.9 billion.

Moreover, the company guided for FY22-adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss to fall in the range of $825 million to $925 million.

The guidance only includes the launch of mobile sports betting in New York and Louisiana in January 2022 and no further state launches. The company also expects to turn Contribution Profit positive for FY22 across all states where it is live.

Analysts’ View

Responding to DraftKings’ quarterly performance, Deutsche Bank analyst Carlo Santarelli reiterated a Hold rating and $19 price target, which implies 9.9% upside potential to current levels.

Not surprised by the market’s reaction to the company’s results, Santarelli said, “We believe the beat and raise revenue guidance strategy is one that worked in the early stages (2020), but, when coupled with widening adjusted EBITDA losses, and more realistic/discerning investor approaches, it is simply not suitable in the current environment.”

The analyst added, “While we believe, over time, DKNG can run a profitable business, which has been our view all along, we simply believe the out-year TAM forecasts are too high, for several reasons, and the margin targets that underlie these forecasts are also too high.”

Overall, the stock has a Moderate Buy consensus rating based on 10 Buys, 8 Holds, and 1 Sell. The average DraftKings price target of $38.83 implies a whopping 124.6% upside potential to current levels.

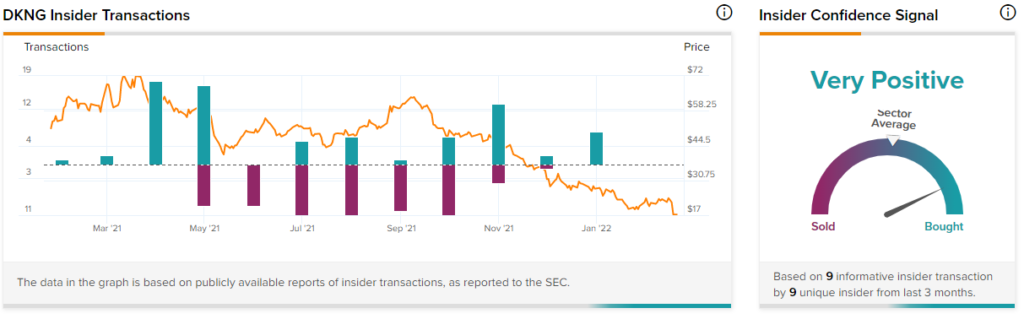

Insider Trading

TipRanks’ Insider Trading Activity shows that Insider Signal is currently Very Positive on DraftKings, with corporate insiders buying $551.2K shares in the last quarter.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Roku Plunges 22% on Q4 Revenue Miss and Weak Guidance

Tesla Drops 5% on Phantom Braking Complaint, Mustang Mach E Takes Top Spot

U.S. Adds AliExpress and WeChat to Notorious Markets List – Report