DraftKings shares rose 3.9% on Nov. 13 as the sports betting company delivered better-than-anticipated 3Q results and raised its full-year revenue outlook.

The company’s 3Q revenue surged 98% year-over-year to $132.8 million, beating analysts’ estimate of $132 million. DraftKings’ (DKNG) top line reflected the impact of the SBTech acquisition and the return of key sporting events in the quarter following COVID-led suspension or postponement in the second quarter. Excluding the impact of SBTech and Diamond Eagle acquisitions, revenue grew 42%.

The company’s monthly unique payers increased 64% to over 1 million. On a reported basis, the company’s loss per share increased to $0.98 in 3Q20, from $0.30 in 3Q19. On an adjusted basis, DraftKings posted a loss per share of $0.57 while analysts expected a loss per share of $0.61. (See DKNG stock analysis on TipRanks)

Commenting on the results, CEO Jason Robins said, “The resumption of major sports such as the NBA, MLB and the NHL in the third quarter, as well as the start of the NFL season, generated tremendous customer engagement.”

“In addition to our year-over-year pro forma revenue growth of 42%, DraftKings recorded an increase in monthly unique payers of 64% to over 1 million, demonstrating the effectiveness of our data-driven sales and marketing approach. Our product offerings and scalable platform provide a distinctive and personalized experience for customers across the ten states where we operate mobile sports betting today, and we look forward to entering additional jurisdictions at the earliest opportunity,” added CEO Robins.

Meanwhile, DraftKings raised its FY20 pro forma revenue guidance to $540 million-$560 million, from the previous outlook range of $500 million-$540 million. The new outlook reflects year-over-year growth of 25%-30%. However, the guidance assumes that all announced sports calendars are maintained through the end of the year. The company also initiated 2021 revenue guidance in the range of $750 million-$850 million.

Following the print, Deutsche Bank analyst Carlo Santarelli lowered his price target to $46 from $48 and reiterated a Hold rating saying, “While there wasn’t much to pick at in the quarter, given the considerable 3Q20 EBITDA loss was previously disclosed and Consensus 4Q20 EBITDA had migrated lower in recent weeks, leaving Consensus roughly in line with managements commentary around the 4Q20 EBITDA result representing roughly half of the 3Q20 loss, we don’t necessarily see much that would have changed investor views here.”

Santarelli further commented, “Accordingly, we expect the market to continue to trade shares around TAM [Total Addressable Market] and growth trajectory views, much of which will be dictated by the pace of legalization and investors garnering a better understanding of how handle ultimately flows to net revenue and, down the road, EBITDA.”

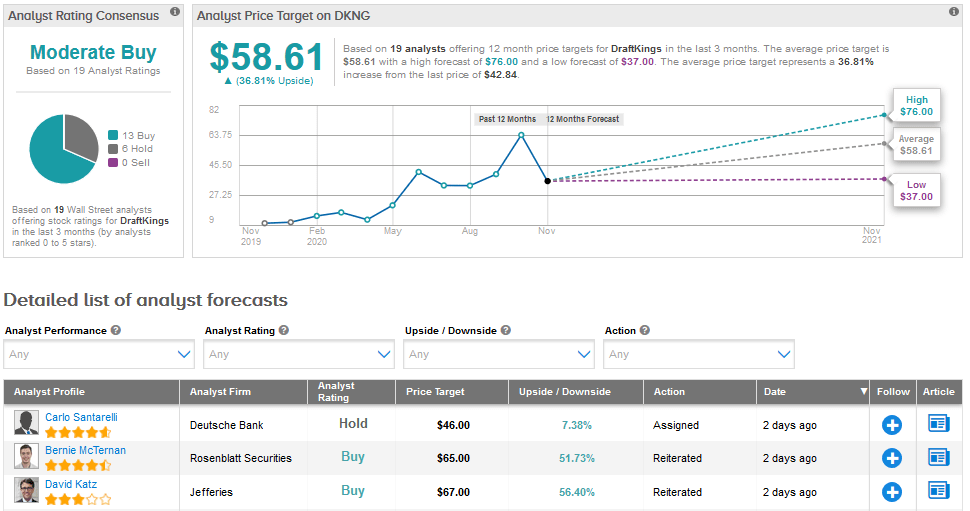

The rest of the Street is cautiously optimistic with a Moderate Buy analyst consensus based on 13 Buys and 6 Holds. The average price target stands at $58.61, implying an upside potential of 36.8% over the coming year. Shares have advanced a staggering 300% year-to-date.

Related News:

Farfetch Pops 18% As Online Luxury Sales Go Through The Roof; Analyst Raises PT

Cisco’s Quarterly Sales Beat The Street; Shares Rise 8%

CyberArk’s 4Q Outlook Disappoints; Shares Drop 9%