Some companies enjoyed last year’s AI-fueled market rally more than others. You can certainly count Palantir (NYSE:PLTR) as one of the main beneficiaries. The big data specialist rode the trend, piling on the gains – all 167% of them.

That share price growth was facilitated by the company leaning heavily into the AI opportunity. In the first half of the year, it unveiled its Artificial Intelligence Platform (AIP). That was swiftly followed by Palantir’s inaugural AIPCon conference in June and a second one in September.

So, it’s clear that the market liked what the company was proposing. However, Monness’ Brian White, a 5-star analyst rated in the top 1% of the Street’s stock pros, says that replicating this success this year will be challenging.

“The introduction of AIP proved pivotal in shifting market sentiment in favor of Palantir,” says White, “however, we believe 2024 won’t be as easy for the stock, especially at current valuation levels. Moreover, we believe enterprises will be thoughtful in adopting next-gen AI platforms this year. Plus, there is no shortage of competing AI solutions in the market.”

White’s comments come ahead of Palantir’s Q4 readout (Monday, February 2). The analyst is calling for revenue of $604.0 million, above the Street at $602.6 million and EPS of $0.08, the same as consensus. Palantir’s guide has revenue in the $599-603 million range and positive GAAP net income.

Looking to 1Q24, White expects the company to guide for revenue of $619.9 million, amounting to a year-over-year increase of 18%, and also bettering the consensus estimate of $615.5 million. Again, White’s EPS expectations meet those of the Street, both forecasting $0.07.

While White’s top-line forecasts exceed the Wall Street average, he refrains from getting on board, due to the stock’s “excessive valuation.” Over the long term, White thinks the company is in a good position to take advantage of the ongoing AI trend and make the most of a “volatile geopolitical landscape.” However, in addition to a rich valuation, the analyst notes that revenue recognition from government-related contracts “has proven lumpy.”

Bottom-line, White Maintained a Neutral rating on the stock without providing a fixed price target. (To watch White’s track record, click here)

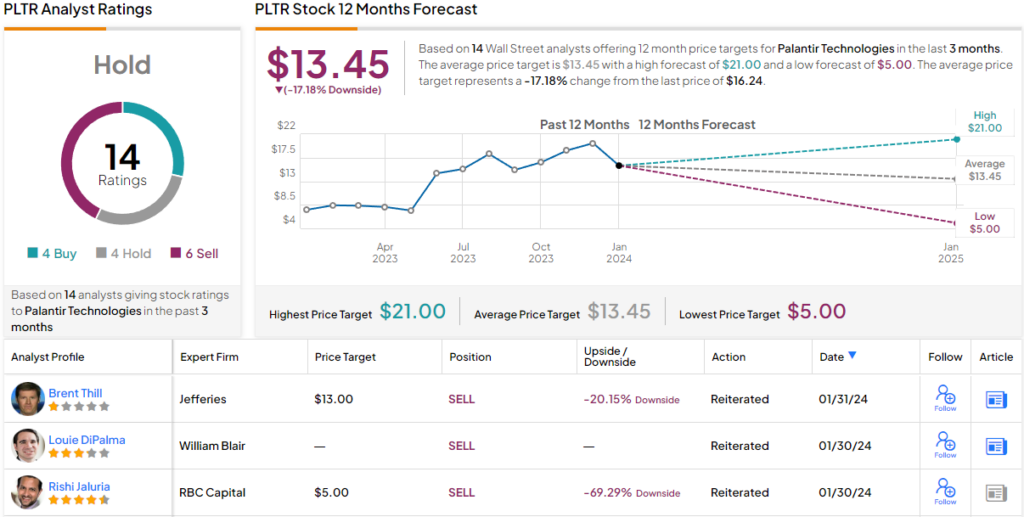

3 other analysts join White on the sidelines and with an additional 4 Buys and 6 Sells, the stock claims a Hold consensus rating. Most also think the shares are overvalued, given the $13.45 average target implies the stock will post a decline of 20% over the coming months. (See Palantir stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Questions or Comments about the article? Write to editor@tipranks.com