It’s been an interesting period for AMC Entertainment (NYSE:AMC) shareholders, for sure. The revival of the meme stock mania following the reappearance of orchestrator Roaring Kitty sent AMC shares parabolic last week.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Sensing an opportunity to put the wild rally to good use, the movie theater chain then announced the completion of a $250 million ATM program launched on March 28 and followed that by saying it will issue class A stock in exchange for notes so the company can reduce its 10%/12% PIK loan by $168.9 million, which is its highest interest loan outstanding. Predictably, those moves got the thumbs down from investors who sent the stock into correction mode.

Debt remains a big issue for AMC and during its recent earnings call, the company hinted that its lenders might consider renegotiating the terms of its debt or extending the maturity dates for its $2.9 billion debt due in 2026.

Considering its record in going about its debt repayments, Wedbush analyst Alicia Reese expects a positive outcome here. “AMC has had repeated success in renegotiating the terms of its debt and extending maturity dates, and we think that it can do so again before the bulk of its debt comes due in 2026,” she said.

AMC grew its market share in 2023 and Reese thinks it can further increase its 22.5% market share while the company also has the opportunity to “drive revenue growth” from its European circuit via theater upgrades that would boost per-screen averages. However, over the next two years, the company is unlikely to go down that path until it “works through balance sheet right-sizing.” Given its heavy debt load and lack of dividends “overshadow any positives,” AMC remains focused on reducing its debt.

It has done good work here but not enough yet. “Since the beginning of 2022, AMC has reduced its debt by $1 billion, but it still has $4.4 billion remaining,” notes Reese. “AMC continues to raise cash from equity sales and must raise more capital in the coming months. AMC’s shareholders continue to resist AMC’s share repurchases. But AMC must cover its interest payments and conserve cash while it posts losses.”

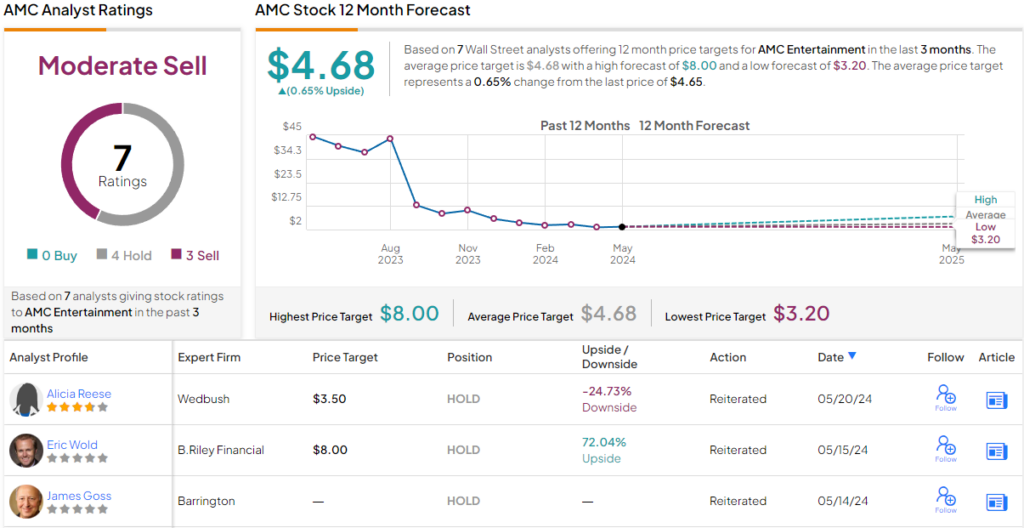

For now, then, Reese remains on the AMC sidelines with a Neutral rating and $3.5 price target. However, the analyst might as well have said ‘Sell,’ considering the figure factors in downside of ~25% from current levels. (To watch Reese’s track record, click here)

Overall, there are currently no positive AMC reviews on file. The 6 other recent analyst reviews split into an even 3 Holds and Sells, each, making the consensus view here a Moderate Sell. The average target stands at $4.68, suggesting the shares will stay rangebound for the time being. (See AMC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.