Domino’s Pizza reported that sales at its UK franchise surged 19% in the third quarter fueled by a reduced value-added tax rate and as more customers made online purchases for comfort food during the coronavirus pandemic.

Domino’s Pizza (DPZ) said that in the quarter ended September, UK online sales, which account for 95.1% of delivery sales, were up 35.6%. In addition, the pizza chain said that sales also benefited from the reopening of contact-free collections and the return of live sport on television during the period.

The UK government’s move on July 15 to slash the VAT rate on hot takeaway food from 20% to 5% helped franchisees mitigate costs and enabled them to pass savings on to customers, the pizza chain said. For the weeks following the rate change, the VAT reduction benefitted UK reported system sales and like-for-like sales growth. However the change has limited direct benefit to profitability, the company said.

Looking ahead Domino’s said it expects full-year underlying pretax profit to range between £93 million and £98 million, compared with the £98.8 million for 2019. The guidance is in line with market consensus.

“Working closely with our franchisees we continue to do everything we can to keep our people and customers safe, including wearing masks, the use of perspex screens, contact free delivery and collection and continued menu rationalisation,” said Domino’s Pizza CEO Dominic Paul. “At the heart of our future plans is realignment with our franchisee partners and we are having detailed discussions to agree a sustainable way forward, although we continue to expect that these discussions will take some time.”

During Q3, five new stores opened in the UK, of which all were franchised, and there was one planned closure. For the 39 weeks to the end of September, 13 stores opened in the UK (by 10 different franchisees). In total the chain had 1,197 stores at the end of Q3.

Meanwhile, Domino’s Pizza in the US last week reported lower-than-expected 3Q earnings of $2.49 per share due to higher Covid-19 costs. The US shares of the largest pizza company in the world based on retail sales have advanced 27% so far this year. (See DPZ stock analysis on TipRanks).

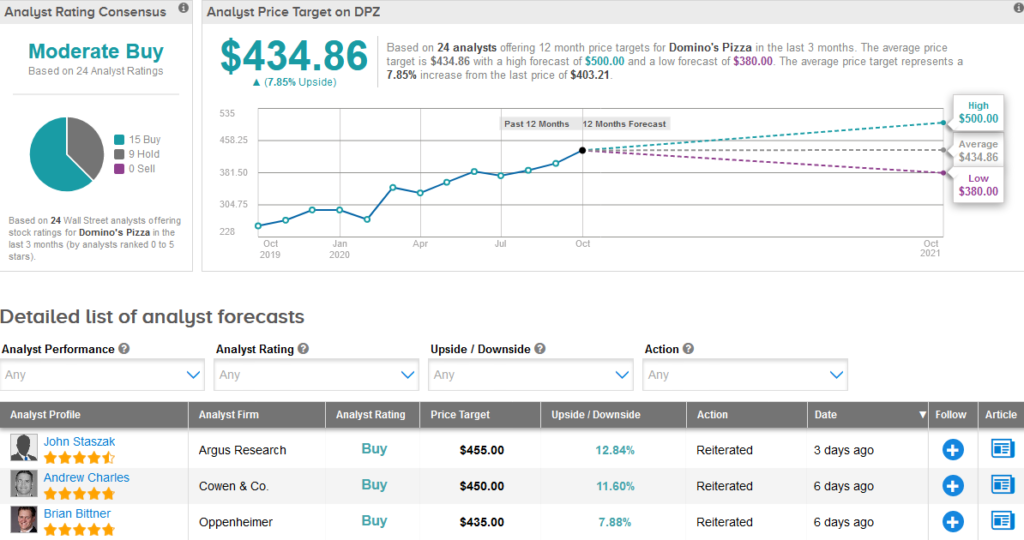

Nonetheless, Wedbush analyst Nick Setyan earlier this month raised the stock’s price target to a Street high of $500 (25% upside potential) from $445 and reiterated a Buy rating saying that he continues to view DPZ as among the best-positioned restaurants to benefit from accelerated market share gains post-COVID.

Overall, analysts have a cautiously optimistic Moderate Buy consensus on DPZ with an average analyst price target of $434.86 (8% upside potential).

Related News:

Walmart To Hire 20,000 Seasonal Workers To Meet Online Demand

Urban Outfitters Executes Management Reshuffle

Apple Launches First iPhone With 5G; Shares Drop