Shares of Domino’s Pizza dropped 7% to close at $339 on Feb. 25 as the world’s largest pizza company, in terms of global retail sales, reported lower-than-expected fourth-quarter results.

4Q adjusted earnings for Domino’s (DPZ) surged 10.5% year-over-year to $3.46 per share, but missed the Street estimates of $3.89 per share. Total revenues increased 18.3% to $1.36 billion, falling short of analysts’ expectations of $1.39 billion.

The company’s US same-store sales grew 11.2% in the quarter, while international same-store sales increased 7.3%. Global retail sales growth was 12%.

Domino’s CEO Ritch Allison said, “We celebrated our 60th year as a company in 2020, and while it was a challenging year in so many ways, it was also a year that saw the Domino’s brand rise to the occasion all over the world.” (See Domino’s stock analysis on TipRanks)

For the next two to three years, the company expects global retail sales to grow 6-10%, excluding the foreign currency impact. Global net unit growth is projected to be 6-8%.

On Feb. 24, the company announced a hike in its quarterly dividend by 20.5% to $0.94 per share. The new dividend will be paid on March 30 to shareholders of record as of March 15. The company’s annual dividend now reflects a dividend yield of 1.11%. Domino’s also declared a new common stock repurchase authorization of up to $1 billion.

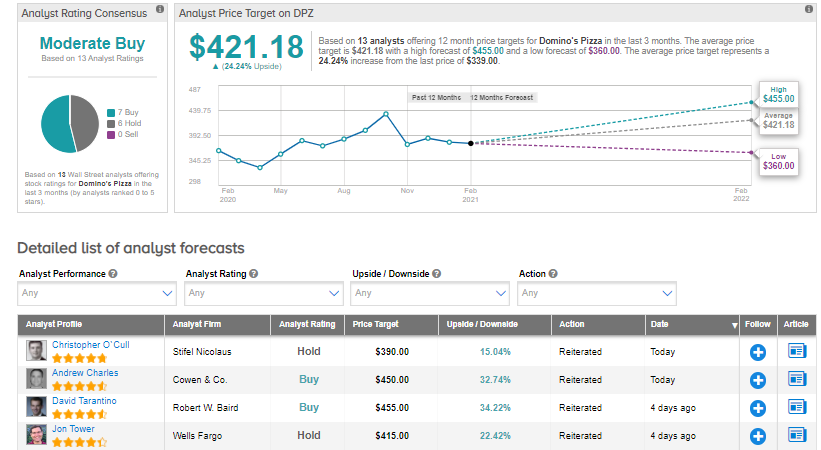

Following the 4Q results, Stifel Nicolaus analyst Christopher O’Cull decreased the stock’s price target to $390 (15% upside potential) from $400 and reiterated a Hold rating. While the analyst is “constructive on the company’s long-term fundamental prospects,” O’Cull anticipates “shares will remain range-bound until investors gain greater comfort the company can retain a significant portion of the sales growth it experienced during the pandemic.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 7 analysts suggesting a Buy and 6 analysts recommending a Hold. The average analyst price target of $421.18 implies more than 24% upside potential to current levels.

Related News:

NiSource Outperforms 4Q Earnings Estimates, Misses On Revenues

Q2 Holdings’ 1Q Sales Outlook Exceeds Street Estimates; Street Is Bullish

Shopify’s 4Q Sales Pop 94% As Online Buying Booms; Shares Dip 3.3%