Dominion Energy (D) delivered mixed third-quarter 2021 results, topping earnings estimates, but falling short of revenue expectations.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

However, shares of the Virginia-based power and energy company, which operates in 16 states across the U.S., gained 1.4% on November 5 to close at $76.53. (See Dominion stock chart on TipRanks)

Quarterly Performance

Q3 adjusted earnings of $1.11 per share exceeded analysts’ expectations of $1.05 per share. The company reported earnings of $1.08 per share in the same quarter last year.

However, revenues declined 11.9% year-over-year to $3.18 billion, falling short of consensus estimates of $3.96 billion.

Dominion Energy Updates FY 2021 Outlook

The company narrowed its operating earnings guidance range for FY 2021 to between $3.80 and $3.90 per share, on assumptions based on normal weather conditions. Furthermore, the company reaffirmed its long-term earnings and dividend growth guidance.

Meanwhile, Q4 adjusted earnings are likely to range between $0.85 and $0.95 per share, while the consensus estimate is pegged at $0.97 per share.

Wall Street’s Take

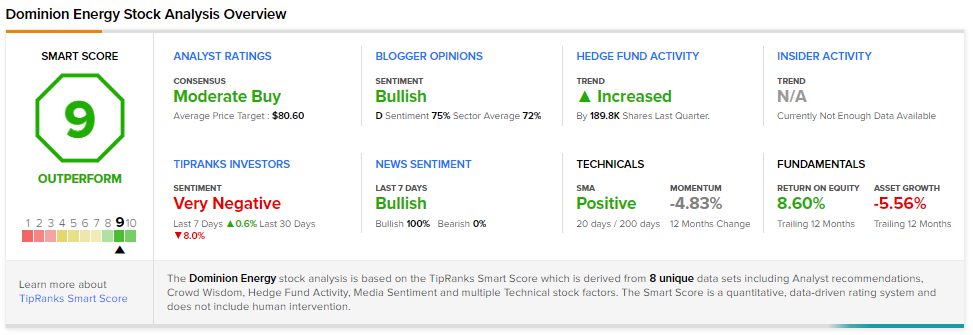

Overall, the stock has a Moderate Buy consensus rating based on 3 Buys and 2 Holds. The average Dominion Energy price target of $80.60 implies a 5.32% upside potential to current levels. However, the company’s shares have lost 8.9% over the past year.

Furthermore, Dominion scores a 9 out of 10 according to TipRanks’ Smart Score rating system, suggesting that the stock is likely to outperform market averages.

Related News:

Exela Dips 11.5% on Quarterly Loss

Qualcomm Posts a Blowout Quarter; Shares Jump 7.5%

Roku’s Q3 Revenues & Q4 Outlook Disappoint