Shares of American multi-price point discount store Dollar Tree, Inc. (DLTR) jumped 9.2% and closed at $144.71 on November 23, after the company exceeded both earnings and sales, and gave upbeat guidance.

The company also announced an increase in its price point to $1.25 throughout its stores to offset the rising prices.

Solid Results

Dollar Tree posted earnings of $0.96 per share, down 30.9% against the prior-year quarter, but 1 cent higher than analyst estimates of $0.95 per share.

Moreover, net sales climbed 3.9% year-over-year to $6.42 billion, surpassing Street estimates of $6.41 billion. Overall comparable same-store sales increased 1.6% year-over-year.

Management Comments

Michael Witynski, President and CEO of Dollar Tree, said, “We experienced a strong finish to the quarter, as shoppers are increasingly focused on value in this inflationary environment. “

He added, “Our Dollar Tree pricing tests have demonstrated broad consumer acceptance of the new price point and excitement about the additional offerings and extreme value we will be able to provide. Accordingly, we have begun rolling out the $1.25 price point at all Dollar Tree stores nationwide. The continuing expansion of our key strategic initiatives, including Dollar Tree Plus, Combo Stores, and the H2 format, are all going well and on, or ahead of, plan”

See Analysts’ Top Stocks on TipRanks >>

Guidance & $1.25 Price Point

Based on the ongoing supply chain and freight issues, Dollar Tree gave conservative guidance for its fourth quarter and FY21. The company expects these issues to run into the year-end and modestly into FY 2022.

To mitigate these inflationary pressures, DLTR has implemented the $1.25 price point which will enable the company to expand its offerings, introduce new products and sizes, reintroduce many customer favorites and key traffic-driving products that were previously discontinued due to the constraints of the $1.00 price point.

For Q4, DLTR forecasts net sales to fall in the range of $7.02 billion to $7.18 billion compared to the consensus estimate of $7.03 billion. Similarly, earnings are projected to be between $1.69 per share and $1.79 per share, while the consensus estimate is pegged at $1.75 per share.

For the full year fiscal 2021, DLTR forecasts net sales and earnings to be in the range of $26.25 billion to $26.41 billion and $5.48 per share to $5.58 per share, respectively.

Analysts’ Take

Encouraged by Dollar Tree’s quarterly performance and the increase to a $1.25 price point across its stores, Gordon Haskett analyst Charles Grom upgraded the stock to a Buy from a Hold rating.

The analyst assigned a price target of $170 to DLTR, which implies 17.5% upside potential to current levels.

Grom believes that the $1.25 price point will position the company to succeed in 2022 and beyond as well as enable it to increase its offerings and mitigate future price pressures.

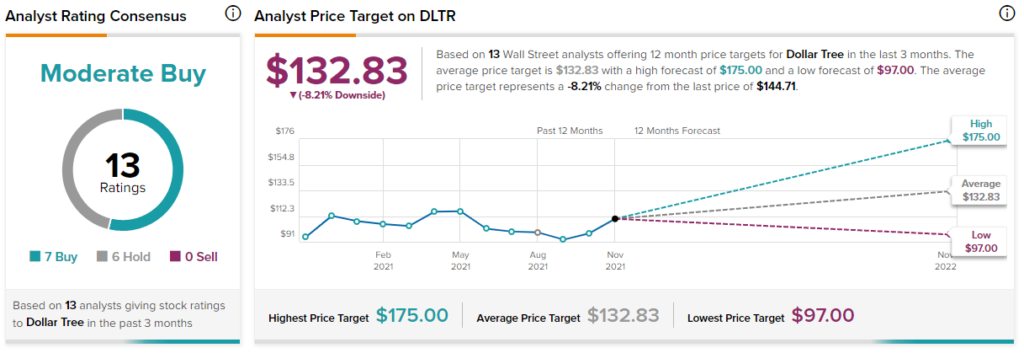

Overall, the stock has a Moderate Buy consensus rating based on 7 Buys and 6 Holds. At the time of writing, the average Dollar Tree price target was $132.83, which implies 8.2% downside potential to current levels. Shares have gained 30% over the past year.

Related News:

Zoom Drops 6.8% Despite Exceeding Q3 Expectations

Urban Outfitters Beats Q3 Estimates; Shares Slump 12%

Keysight Technologies Tops Q4 Results; Shares Fall