Dollar Tree, Inc. (DLTR), a discount retail store operator that sells items for $1 or less, has announced that its Board approved a $1.05 billion increase to its share buyback program. The total buyback authorization now stands at $2.5 billion. Shares soared 16.5% on the news, closing at $100.51 on September 29.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Notably, the company has $1.45 billion remaining under its previous repurchase authorization, which was approved by the Board on March 2, 2021. (See Dollar Tree stock charts on TipRanks)

Subject to market conditions, the company can buy back its common shares in the open market from time to time or through privately negotiated transactions up to the value of the newly authorized share repurchase program.

The company stated that it has repurchased $950 million worth of its common stock in Fiscal 2021, as it believes in delivering value to shareholders and customers through such actions.

Commenting on the news, Michael Witynski, President, and CEO of DLTR, said, “We are committed to a disciplined capital allocation strategy that balances returning capital to our shareholders and investing in our business for growth… Over the past several years, we have paid down more than $4 billion in debt and returned to an investment-grade rating. As a result, with the meaningful free cash flow from our business, we expect to maintain share repurchasing as an important part of our capital allocation strategy.”

Yesterday, Jefferies analyst Randal Konik reiterated a Hold rating on the stock with a price target of $100, implying that shares are fully valued at current levels.

Konik believes that the addition of new offerings of more than the $1 price point across all Dollar Tree Plus stores and select legacy DT stores will have a positive impact on its financials.

The analyst also noted that DLTR has turned to Mexico for the supply of many of its offerings due to ongoing supply-chain constraints from Asian countries, which will prove beneficial for Dollar Tree.

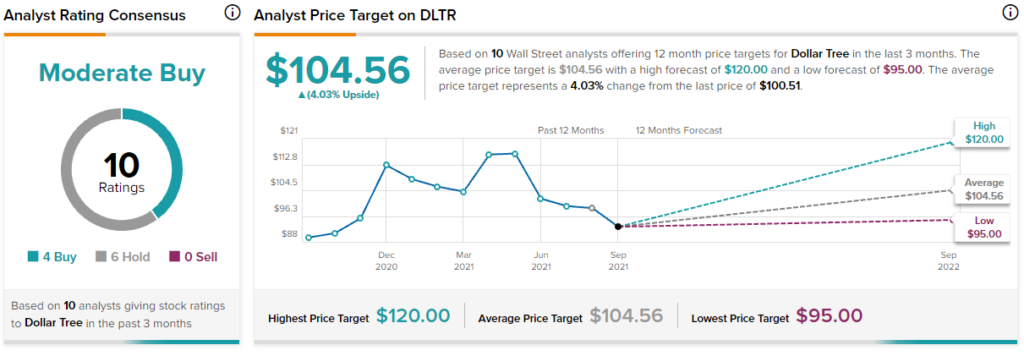

Overall, the stock has a Moderate Buy consensus rating based on 4 Buys and 6 Holds. The average Dollar Tree price target of $104.56 implies 4% upside potential to current levels. Shares have gained 10% over the past year.

Related News:

United Natural Foods Hits New Record High, Exceeds Q4 Expectations

FactSet Research Beats Q4 Expectations; Shares Jump

Sherwin-Williams Lowers Q3 and FY21 Guidance; Shares Fall