Dollar Tree (DLTR), a discount variety retail store operator that sells items for $1 or less, announced better-than-expected first-quarter results. However, shares closed almost 8% lower on May 27 as the company provided higher freight cost guidance and a FY2021 earnings outlook that came in below expectations.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company reported consolidated net sales of $6.48 billion that surpassed the Street’s estimates of $6.41 billion and rose 3% from the year-ago period. Enterprise same-store sales grew 0.8% on a constant-currency basis.

Earnings came in at $1.60 per share, beating the consensus estimate of $1.40 per share, and soared 53.8% year-over-year.

Dollar Tree CEO Michael Witynski said, “Looking forward, I am most excited about the growth of Dollar Tree Plus! and our strategic store formats, which shoppers are responding to favorably, as evidenced by market share gains and improved customer satisfaction scores. These offerings, along with other key sales- and traffic-driving initiatives and a robust balance sheet, give us confidence that we have increased the long-term earnings potential for both banners.” (See Dollar Tree stock analysis on TipRanks)

For Fiscal 2021, management expects adjusted earnings to be $5.80 – $6.05 per share versus the consensus estimate of $6.24. Freight costs in the last three quarters of FY2021 are anticipated to be $0.70 to $0.80 higher than the prior-year period.

Following the Q1 earnings release, Raymond James analyst Bobby Griffin maintained a Hold rating.

Griffin commented, “While we choose to remain on the sidelines for now, we were encouraged by the gross margin expansion in both business segments and the continued strength in the discretionary side of the business.”

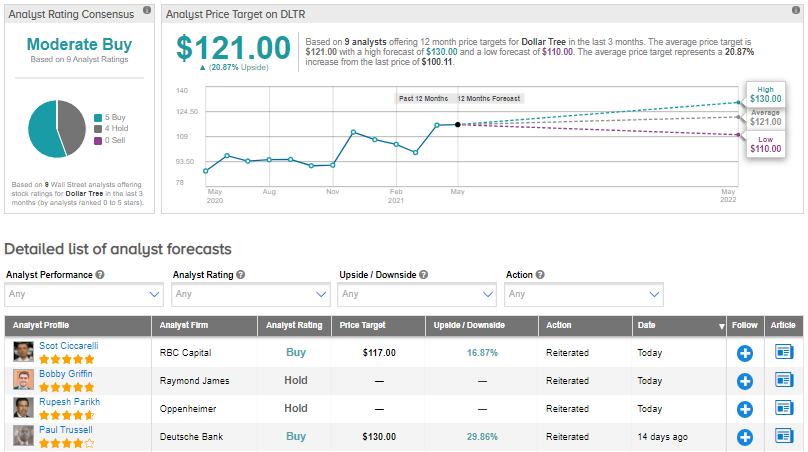

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 5 Buys versus 4 Holds. The average analyst price target of $121 implies 20.9% upside potential to current levels. Shares have increased 2.5% over the past year.

Related News :

Workday Beats Analysts’ Expectations in Q1; Shares Down

Abercrombie & Fitch Delivers Strong Q1 Results; Shares Pop 8%

Garmin Expands Digital & Aviation Offerings with AeroData Buyout