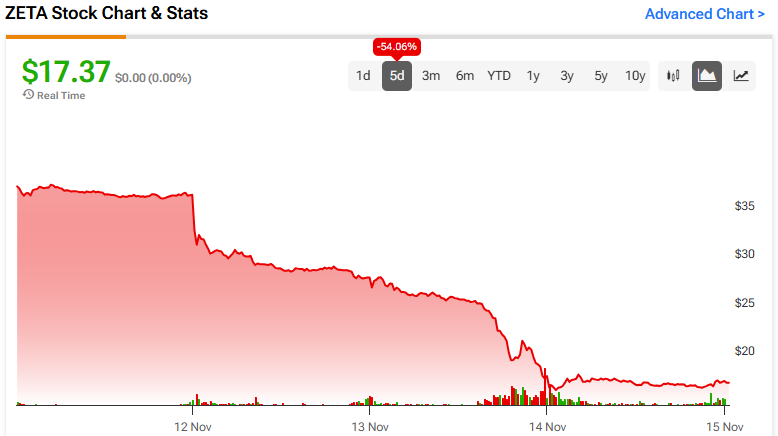

Zeta Global Holdings (ZETA), a data-driven cloud platform giant with unique marketing automation software, is facing a significant decline in share price, dropping over 50% in the days following a short report from Culper Research accusing it of underhand data collection practices. However, the company refutes these allegations and has received support from its Board of Directors, who authorized a stock repurchase program to highlight its unwavering confidence in its strategy and future growth prospects.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Zeta’s recent acquisition of LiveIntent, a pioneer in people-based marketing, and positive financial updates like an increasing customer count further reinforce this confidence. However, heightened regulatory risks cloud the path forward. This is an inflection point for the company, and investors attracted by the potential buy-on-the-dip opportunity should proceed with a clear-eyed understanding of the risks.

Zeta Battles Short-seller Report

Zeta is an international company offering a cloud platform that employs omnichannel data-driven technology. Its Consumer Data Platform (CDP) provides businesses consumer intelligence and marketing automation software. It can analyze billions of structured and unstructured data points to predict consumer intention, using machine learning algorithms and substantial opted-in data for omnichannel marketing.

The company’s platform ingests, examines, and simplifies various data points to provide a comprehensive view of a consumer, including identity, profile traits, behaviors, and purchase intent. Zeta also provides product suites like the agile intelligence suite, which uses Zeta’s and customer-generated data to discover consumer insights for marketing programs. The CDP consolidates various databases and data feeds, organizing them based on needs and performance metrics. Furthermore, the company acquired LiveIntent, a pioneer in people-based marketing, to bolster the platform.

Culper’s Short Report

Culper Research recently disclosed a short position in Zeta, citing questionable business practices concerning data acquisition. In the report, Culper alleged that Zeta employs deceptive practices like third-party consent farms to acquire consumer data, contributing significantly to Zeta’s growth and adjusted EBITDA. The allegations caused the share price to plummet over 50%. The nature of the report and the subsequent halving of the company’s value make shareholder litigation highly likely.

In response, Zeta issued a statement debunking Culper’s allegations as misleading, inaccurate, and based on speculative conjecture. The company stands by its internal accounting processes, controls, and revenue recognition practices. In a further vote of confidence, the company’s Board of Directors approved a stock repurchase program, which authorizes up to $100 million in Class A common share repurchases. This move aims to take advantage of the company’s current undervalued stock and utilize the company’s excess free cash flow.

Zeta’s Recent Financial Results & Outlook

The company recently announced its financial results for the third quarter. Revenue was $268.3 million, a 42% year-over-year increase, surpassing analysts’ expectations by $15.8 million. Direct platform revenue grew 41% year-over-year, while Scaled and Super-Scaled Customer counts grew, with the latter’s average revenue per user (ARPU) increasing 30% year-over-year.

The company’s adjusted EBITDA increased by 59% year-over-year to $53.6 million, and the adjusted EBITDA margin grew to 20.0% from 17.9% in 3Q’23. Operating cash flow increased to $34.4 million, and free cash flow increased to $25.7 million. Yet, the company reported a net loss of $17.4 million, though this was a significant improvement compared to last year’s third-quarter net loss of $43.1 million. GAAP earnings per share (EPS) of -$0.09 missed consensus expectations by $0.03.

Forth-Quarter’s Guidance

Zeta’s management has issued guidance for the fourth quarter of 2024, increasing revenue to an estimated $293.0 million to $297.0 million, an increase of $32 million from the previous midpoint guidance of $263 million. Similarly, adjusted EBITDA guidance has risen from $64.9 million to $66.9 million, a significant $6.5 million increase.

For the full year of 2024, management has raised revenue guidance from $925 million to an anticipated $984.1 million to $988.1 million. This represents a year-over-year increase of 35% to 36%. Adjusted EBITDA guidance has also surged from $187.5 million to $189.5 million, indicating a year-over-year rise of 45% to 46% and an Adjusted EBITDA margin of 19.0% to 19.3%. Free Cash Flow guidance has also seen an increase, with predictions ranging from $88 million to $92 million, a $5 million increase from the earlier guidance midpoint of $85 million.

What Is the Price Target for ZETA Stock?

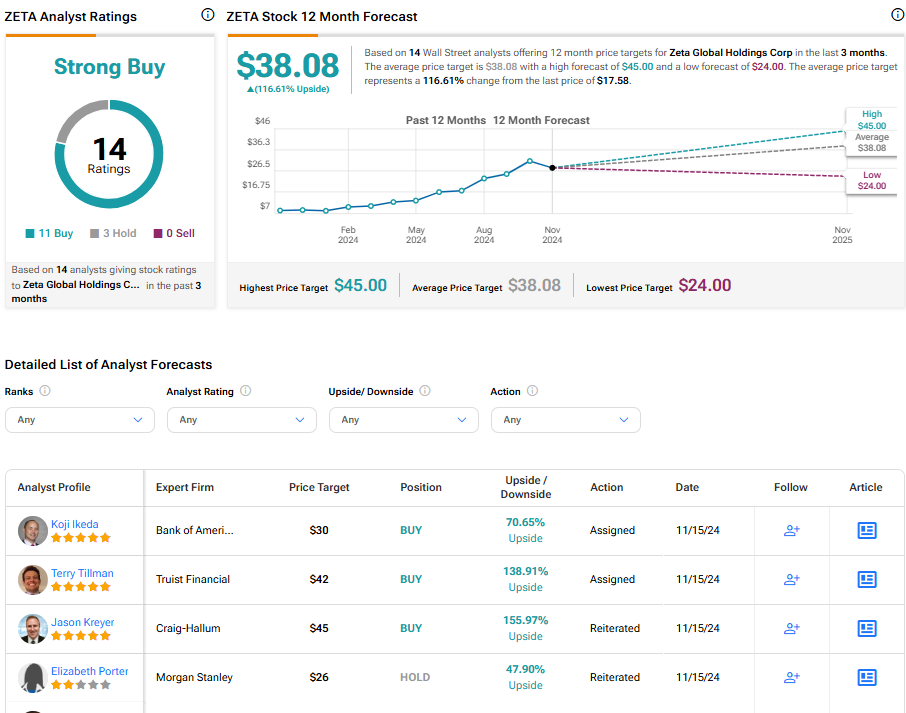

Despite the dramatic price drop, shares are still up 106% over the past year. They trade near the middle of the 52-week price range of $7.65 – $38.20 and show ongoing negative price momentum as they trade below the 20-day (27.96) and 50-day (27.72) moving averages. The P/S ratio of 3.5x sits well below the Infrastructure Software industry average of 9.6x, marking the stock as relatively undervalued.

Zeta Global Holdings is rated a Strong Buy overall, based on 14 analysts’ aggregate recommendations. The average price target for ZETA stock is $38.08, representing a potential upside of 116.61% from current levels.

Final Thoughts on ZETA

Zeta Global has faced considerable turbulence following a severe stock price drop sparked by allegations of dubious data collection practices. Despite these challenges, the company firmly believes in its growth trajectory and robust business model, underscored by management’s forward guidance and its Board’s initiation of a stock repurchase program. The downturn in share price has pushed the stock into value territory, making it a potential buy-on-the-dip candidate for those willing to take on the attendant risks.