Shares in DocuSign (DOCU) dropped 9% in Thursday’s trading, and 9% after-hours, despite the company reporting a very strong F2Q21 with revenue 7.6% above guidance and billings 20% above.

Specifically, Q2 Non-GAAP EPS of $0.17 beat Street estimates by $0.09, although GAAP EPS of -$0.35 missed consensus expectations by $0.07. Revenue was particularly impressive, soaring 45% year-over-year and, at $342.2M beating consensus estimates by $23.65M.

Similarly, billings of $405.6M easily beat the $340.1M consensus. Operating margins also exceeded the consensus expectation, coming in at 9.9% vs consensus at 5.1%.

“In an accelerating digital world where business can be conducted from anywhere, the need to agree electronically and remotely has never been stronger, as shown in our 61% year-over-year billings growth. We are just scratching the surface of our Agreement Cloud opportunity and believe we are increasingly becoming an essential cloud-software platform for organizations of all sizes,” says CEO Dan Springer.

Looking forward, DOCU is now guiding for F3Q21 revenue to be $358M-$362M (+44.3% Y/Y at the midpoint) vs. consensus $335.1M, and billings of $380-$390M vs. consensus $361.7M.

For the full year, the company boosted its revenue guidance to $1.384B-$1.388B (+42.3% at MP) vs. consensus $1.317.1B, up from $1.313B-$1.317B previously. That’s with billings of $1.623B-$1.643B.

Alongside the earnings release, DocuSign revealed that it was promoting the current CFO, Michael Sheridan, to President of International. Cynthia Gaylor, board member and audit chair, will now take the role of CFO.

“The revenue beat was ahead of the prior quarter outperformance while billings outperformance was in line” cheered RBC Capital analyst Alex Zukin post-print. “DocuSign noted that the strong billings beat was driven by a strong need to agree electronically and remotely in the current environment” he added.

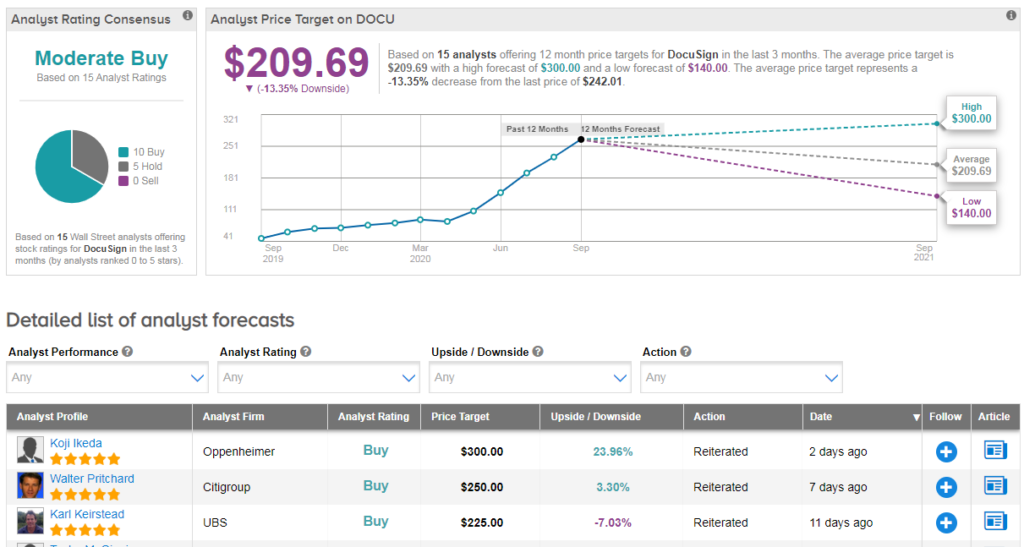

The analyst reiterated his buy rating on the e-signature specialist with a $230 price target. (See DOCU stock analysis on TipRanks).

Overall the stock boasts a cautiously optimistic Moderate Buy Street consensus. With shares up a whopping 227% year-to-date, the average analyst price target of $210 indicates 13% downside potential from current levels.

Related News:

Five Spikes 7% In After-Hours As 2Q Sales Top Estimates

Ambarella Drops 3% In Pre-Market On Dim 3Q Sales Outlook

Copart Gains 4% in After-Hours On Quarterly Sales Win