DocuSign (DOCU) emerged as a top performer during the pandemic as demand for remote solutions accelerated the adoption of digital workflows, including e-signatures. However, the company has recently experienced a significant contraction, shedding roughly 80% over the past three years. Despite the downturn, DocuSign remains a key player in e-signatures and digital transaction management, boasting a network of around 1.6 million customers across 180 countries. The company now incorporates AI-driven agreement management software to capitalize on growing market segments.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The stock trades at a discount to peers in the Software Application industry, making it potentially attractive to contrarian-oriented value investors.

DocuSign Adopting AI

DocuSign is a top provider of electronic signature solutions, offering various products to simplify the process of creating, negotiating, and managing agreements. The company currently serves approximately 1.6 million customers globally, impacting over a billion people in 180 countries with its solutions. DocuSign’s products have received FedRAMP authorization, making them suitable for use by U.S. federal government agencies.

The recent launch of DocuSign Intelligent Agreement Management (IAM) is a note-worthy stride. This AI-powered cloud software aids in streamlining and automating agreement procedures. Its applications include IAM Core, IAM for Sales, and IAM for CX, all of which are now generally available in the U.S. The company plans to extend IAM to its enterprise and self-service customers across other regions over the fiscal year.

DocuSigns’ Recent Financial Results & Outlook

The company recently reported second-quarter results. Revenue was $736 million, a 7% year-over-year increase and a result that beat expectations by $8.16 million. Gross margin remained consistent at 82.2% compared with 82.3% a year ago. Operating activities generated a net cash inflow of $220.2 million, an increase from $211.0 million in the previous year, with free cash flow reaching $197.9 million, up from the $183.6 million reported last year. Non-GAAP net income per diluted share (EPS) showed a considerable year-over-year increase from $0.72 to $0.97, beating consensus estimates by $0.16.

As of the quarter’s end, cash, cash equivalents, restricted cash, and investments totaled $1 billion. Furthermore, common stock repurchases escalated significantly to $200.1 million compared to a mere $30 million in the same period last year.

Following the second-quarter results, DOCU’s management has provided guidance for the third quarter, projecting total revenue from $743 million to $747 million, with subscription revenue estimated between $722 million and $726 million. Billings are expected to land between $710 million and $720 million. The non-GAAP gross margin is anticipated to be between 81.0% and 82.0%, while the non-GAAP operating margin is between 28.5% and 29.5%.

What Is the Price Target for DOCU Stock?

The stock has rebounded from its extended downturn, climbing 27% over the past year. It trades in the upper half of its 52-week price range of $38.11 – $64.76 and shows positive momentum by trading above its 20-day (56.58) and 50-day (55.90) moving averages. The P/E ratio of 11.75x appears to be a significant relative discount to the Software Application industry average P/E ratio of 53.90.

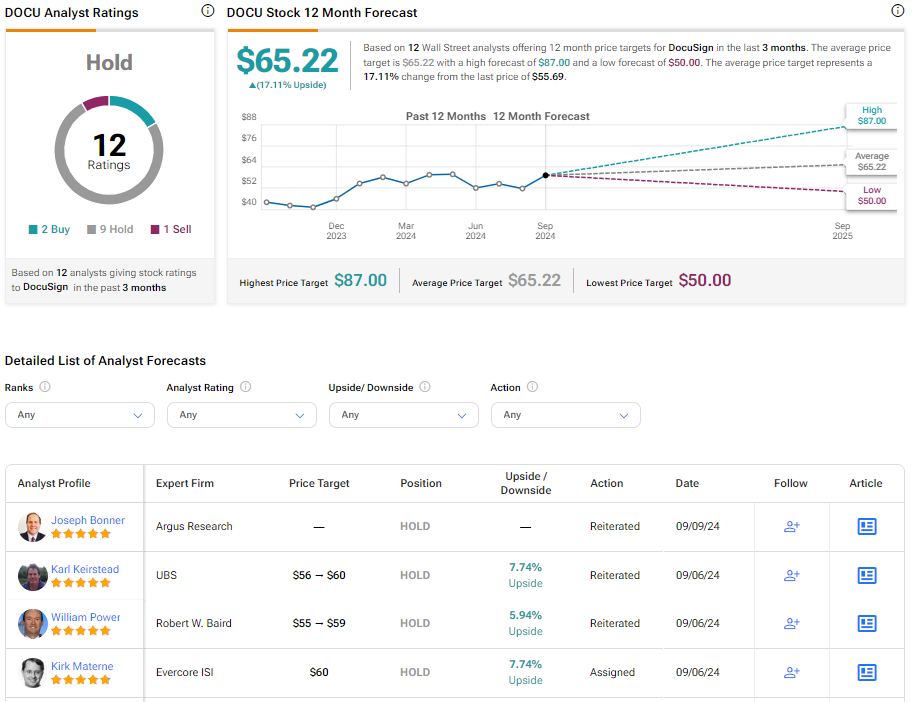

Analysts covering the company have taken a cautiously optimistic stance on DOCU stock. For instance, BofA analyst Bradley Sills recently reiterated a Neutral rating on the shares while raising the price target to $68 from $60, noting that Q2 results suggest that the company is executing well on key growth and productivity efforts.

DocuSign is rated a Hold based on 12 analysts’ recent recommendations and price targets. The average price target for DOCU stock is $65.22, representing a potential upside of 17.11% from current levels.

DOCU in Summary

Despite experiencing a significant contraction, DocuSign continues to demonstrate potential upside in e-signatures and digital transaction management by capitalizing on adopting AI-based agreement management software to leverage growth in emerging market segments. It recently reported top-and-bottom-line beats, pointing to positive financial momentum. With the potential for further upside and trading at a relative value, DocuSign presents an intriguing opportunity for contrarian-oriented value investors.