DocuSign, Inc. (DOCU) delivered robust third-quarter results with both earnings and revenue exceeding estimates by a huge margin. However, shares crashed 29.7% during the extended trading session on December 2, after the company provided lower-than-expected Q4 and FY22 guidance.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

DocuSign enables customers to manage electronic agreements and signatures. With a market cap of $46 billion, its shares have gained a modest 1.2% over the past year.

Robust Results

DocuSign’s quarterly earnings rose a whopping 163.6% year-over-year to $0.58 per share, 12 cents higher than analysts’ estimates of $0.46 per share.

Furthermore, revenue came in at $545.46 million, a 42% growth against the prior-year quarter, meaningfully outpacing analysts’ estimates of $530.63 million.

Compared to Q3FY20, DocuSign’s Billings jumped 28%, Subscription revenue grew 44%, while Professional Services and Other revenue rose a modest 4%.

Management Comments

DocuSign CEO, Dan Springer, said, “Third quarter revenue growth of 42% year-over-year and operating margin of 22% exceeded our expectations. After six quarters of accelerated growth, we saw customers return to more normalized buying patterns, resulting in 28% year-over-year billings growth… With a $50 billion TAM and 1.11 million customers worldwide, we are confident in the value DocuSign delivers in an increasingly digital anywhere economy.”

See Analysts’ Top Stocks on TipRanks >>

Lower-Than-Expected Guidance

Based on the current economic environment and business momentum, DocuSign forecasts Q4 revenue to fall in the range of $557 million to $563 million, lower than the consensus estimate of $573.79 million. Meanwhile, total billings are expected to be between $647 million and $659 million.

Additionally, full-year fiscal 2022 revenue is projected to be between $2.083 billion and $2.089 billion, lower than the consensus estimate of $2.09 billion. Meanwhile, total billings are expected to be between $2.335 billion and $2.347 billion.

Analysts’ Consensus

With 15 Buys and 1 Hold, the DOCU stock commands a Strong Buy consensus rating. The average DocuSign price target of $336.36 implies 43.8% upside potential to current levels.

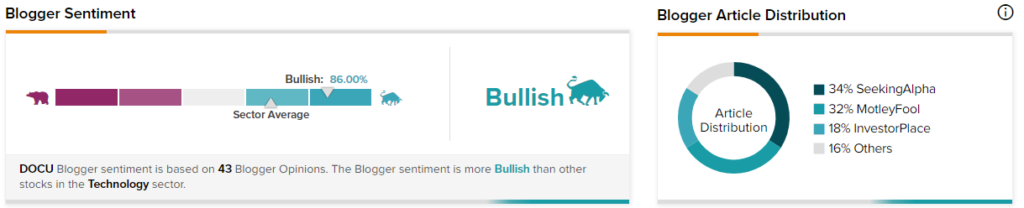

Blogger Opinion

TipRanks data shows that financial blogger opinions are 86% Bullish on DOCU, compared to a sector average of 68%.

Related News:

Square Renamed to Block, Paving Way for Future Growth

Snowflake Up 16% on Solid Q3 Revenue & Guidance

Five Below Jumps 9% on Outstanding Q3 Beat