Diversey Holdings, Ltd. (NASDAQ: DSEY) has completed the acquisition of Shorrock Trichem, marking the 5th acquisition made by the company in the last 13 months. The financial terms of the deal have been kept under wraps.

Based in the U.S., Diversey Holdings, Ltd. is a leading provider of cleaning and hygiene products in the hospitality, healthcare, food and beverage, food service, retail, and facility management sectors.

Benefits of the Deal

Based in Northwest England, Shorrock is a family-owned business that distributes hygiene, infection prevention, and cleaning solutions. It reports annual revenues of over $30 million.

The addition of Shorrock Trichem will strengthen Diversey’s leading market position in the UK and bolster its portfolio of products and services, including innovative sustainability solutions. Further, Shorrock’s strong employees and distribution infrastructure will enable Diversey to improve its sales and service capabilities, leading to better customer service.

The acquisition aligns with Diversey’s strategy to acquire lucrative businesses at accretive purchase multiples, which also boosts its scale, infrastructure, product, and strategic capabilities. Furthermore, it will strengthen the geographical footprint in key markets, thereby maximizing financial returns.

Management Weighs In

Diversey CEO, Phil Wieland, “This acquisition strengthens our position in the UK, one of our key geographies. The combination of our businesses will allow us to offer a broader range of products, solutions, and services to both our distributors and direct customers.”

Diversey’s Head of UK & Ireland, Shane Mahoney, said, “Shorrock Trichem has a great team of experienced people, shares our approach to excellent customer service, and has outstanding products which complement our own portfolio in areas such as warewashing and laundry equipment sales. We expect to be able to reach new markets and strengthen our combined capabilities for both new and existing customers.”

Wall Street’s Take

On January 21, Barclays analyst Manav Patnaik decreased the price target on Diversey to $13 (20.7% upside potential) from $16 and reiterated a Hold rating on the shares.

Patnaik expects Diversey to witness the same pressures from higher short-term costs as its peers.

Consensus among analysts is a Strong Buy based on 6 Buys and 2 Holds. The average Diversey Holdings price target of $18.13 implies 80.58% upside potential to current levels.

Investors Weigh In

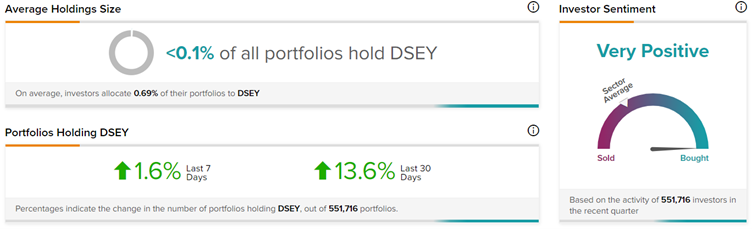

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Diversey, with 13.6% of investors increasing their exposure to DSEY stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Why Did Peloton Shares Plunge 24%?

Intel to Invest $20B in Mega Chip Factories in Ohio

Targa Resources Bumps up Quarterly Dividend by 250%