The domestic box office could be headed for a major resurgence this Thanksgiving, buoyed by three blockbuster hits: Disney’s (DIS) Moana 2, Universal’s (CMCSA) Wicked, and Paramount’s (PARA) Gladiator II.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Disney’s Moana 2 Could Rake in Between $120M and $150M

According to a CNBC report citing box-office analysts, the five-day weekend, from Wednesday to Sunday, could surpass $200 million in ticket sales, potentially marking the biggest Thanksgiving haul since the pandemic. Disney’s Moana 2, which debuted on Wednesday, could earn between $120 million and $150 million at the U.S. and Canadian box offices. Meanwhile, Wicked and Gladiator II, in their second weekends, are set to sustain strong momentum.

The report quoted Shawn Robbins, director of analytics at Fandango, who said, “The trifecta of ‘Moana 2,’ ‘Wicked,’ and ‘Gladiator II’ is a bona fide perfect storm for movie theaters this Thanksgiving.” He noted that this year’s lineup is reminiscent of pre-pandemic Thanksgiving periods when major releases regularly drew audiences of all demographics.

Thanksgiving Is an Important Holiday for the Entertainment Industry

Thanksgiving has historically been a crucial holiday for the film industry, and according to Comscore data, box office receipts have not exceeded $200 million since 2019. The current record for the holiday weekend stands at $315 million, set in 2018 by Ralph Breaks the Internet, Creed II, and Fantastic Beasts: The Crimes of Grindelwald.

Disney, in particular, is counting on Moana 2, as its recent string of releases has failed to impress. The company’s Thanksgiving releases in recent years, such as Encanto and Strange World, underperformed at the box office.

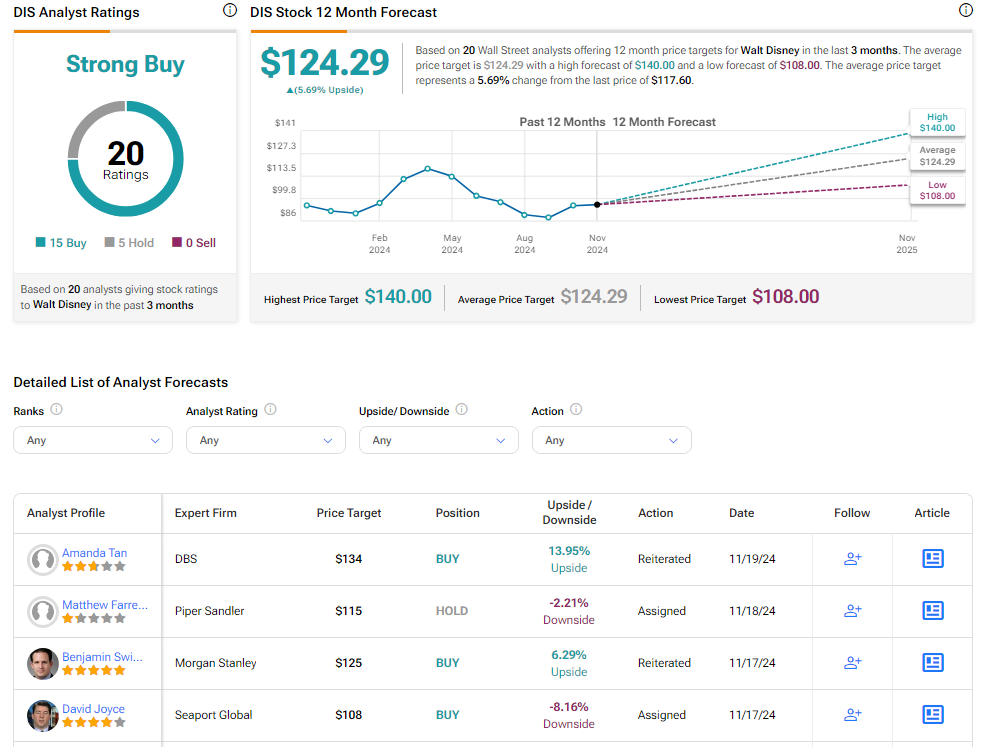

Is Disney Stock a Buy or Hold?

Turning to Wall Street, analysts have a Strong Buy consensus rating on DIS stock based on 15 Buys and five Holds assigned in the past three months, as indicated by the graphic below. After a 28.1% rally in its share price over the past year, the average DIS price target of $124.29 per share implies 5.7% upside potential.