Entertainment and media giant The Walt Disney Co. (NYSE: DIS) is slated to release its third quarter Fiscal 2022 results on August 10. Disney’s primary offerings include theme parks, online streaming services, and movie production. DIS stock has lost 30.4% so far this year.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The Street expects Disney to post adjusted earnings of $0.99 per share in Q3, higher than its comparative prior year period’s figure of $0.80 per share. Meanwhile, revenue is pegged at $21.01 billion, representing year-over-year growth of 23.4%.

Disney’s Q2 Website Traffic Trends are Encouraging

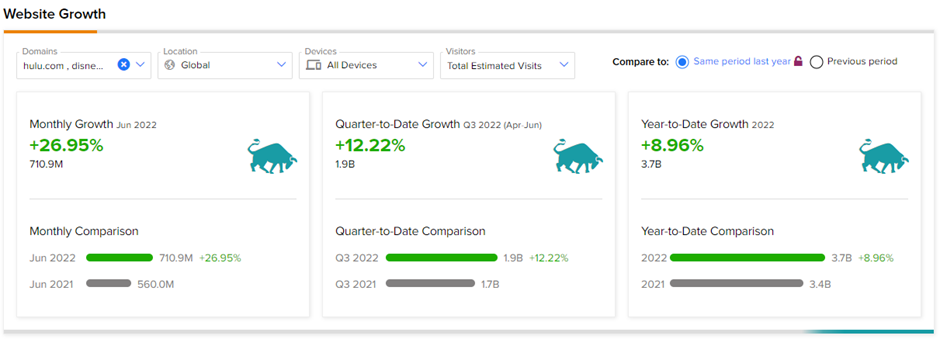

TipRanks Website Traffic Tool signals that Disney is set to report solid Q3 results. As per the tool, in Q3, the total estimated visits to all of Disney’s websites advanced 12.22% compared to the same period of last year. June alone contributed a robust 26.95% year-over-year growth.

Furthermore, TipRanks Website Traffic Tool indicates that the year-to-date estimated visits rose 8.96% compared to the same period last year. These numbers hint that Disney is set to post a solid third-quarter performance. There has also been a sequential growth of 10.19% in the third quarter’s total estimated visits.

Learn how Website Traffic can help you research your favorite stocks

While Disney’s parks and movies suffered a setback during the pandemic, the stay-at-home mandates bolstered its streaming services. On the contrary, now that the economies have opened up, people are venturing out more, which may have led to increased park visitations, and there has also been an uptick in the number of moviegoers.

Meanwhile, its streaming services are experiencing a lull in demand due to stiff competition. Moreover, inflationary pressures and the lurking fears of a recession may also have tarnished Disney’s performance in the quarter.

Is Disney a Buy, Sell or Hold?

On TipRanks, DIS stock has a Moderate Buy consensus rating based on 17 Buys and eight Holds. The average Walt Disney price target of $136.13 implies 24.8% upside potential to current levels.

As mentioned, analysts are cautiously optimistic about DIS stock owing to the unfavorable macroeconomic backdrop, which may hurt the demand for Disney’s offerings across the spectrum.

Nonetheless, retail investors are showing confidence in the media powerhouse and have increased their exposure to DIS stock by 1.1% over the last 30 days.

Ending Thoughts

Disney offers diverse services in the entertainment sector. As the TipRanks Website Traffic Tool suggests, there has been a rise in global visits to all of Disney’s websites, which means that the company is very likely to report strong quarterly performance. Furthermore, despite the cautious tone, Disney’s stock forecast shows a modest upside potential for the next twelve months, making it a good bet in the segment.