Institutional Shareholder Services (ISS), a proxy advisory firm, has backed activist investor Nelson Peltz in the ongoing dispute regarding restructuring Disney’s (NYSE:DIS) board. ISS suggested that Disney shareholders endorse Peltz’s addition to the board at the upcoming annual shareholder meeting on April 3.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

ISS also recommended supporting 11 out of 12 nominees suggested by Disney. Furthermore, ISS advised against voting for three nominees proposed by another activist investor, Blackwells Capital. The proxy advisory firm believes Peltz’s involvement could reassure investors about the board’s engagement in the succession process and contribute to future capital allocation decisions.

Disney Hits Back

Disney has expressed disagreement with ISS’s recommendation to vote for Peltz and asserts that its 12 Board nominees are the most qualified to ensure diligent management and deliver sustainable shareholder value. Disney further contends that Nelson Peltz lacks additional skills beneficial to the board and has no substantial plan to enhance shareholders’ value.

Notably, the proxy battle between Disney and Peltz revolves around the disagreement over Disney’s strategic direction and initiatives to enhance growth. Peltz initiated a proxy contest with Disney in January 2023. Peltz’s Trian Fund Management contested Disney’s strategy, pointing to the subpar performance of DIS stock relative to the overall market. Additionally, Trian criticized the company’s inadequate succession planning, excessive executive compensation, high levels of debt, and Direct-to-Consumer strategy.

Earlier, the heirs of Walt and Roy Disney, the founders of the entertainment giant, supported the company’s CEO, Robert Iger, in the proxy fight. Additionally, Glass, Lewis, a proxy voting and corporate governance advisory firm, advised shareholders to vote for all of Disney’s 12 director nominees.

Is Disney a Buy, Sell, or Hold Stock?

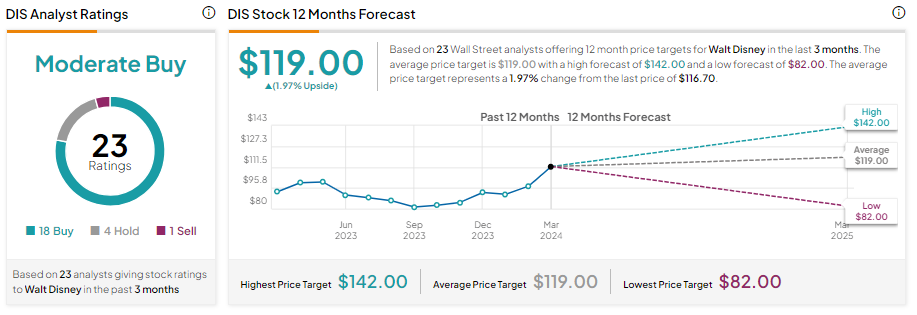

Disney stock is up over 29% year-to-date, outperforming the S&P 500’s (SPX) gain of about 9.5%. DIS stock has a Moderate Buy consensus rating based on 18 Buys, four Holds, and one Sell. The analysts’ average price target on DIS stock of $119 implies a 1.97% upside potential.