Media and amusement park company Disney (DIS) is betting that vacationers will increasingly seek happiness on its cruise line. The Disneyworld operator plans to increase the number of cruise ships it owns from six to 13 by 2031. This comes from Disney investing $60 billion in its Experiences division over the next 10 years.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Disney’s investment in its cruise business doesn’t come without merit. The cruise industry is rising as travelers return after the pandemic temporarily put a hold on leisure sea travel. Disney has benefited from this, with its passenger cruise days increasing 14% in 2023. Additionally, these cruises can capitalize on customers worldwide who want the Disney experience but don’t live near one of its parks.

Bob Iger Leads Disney’s Turnaround

This new focus on cruise experiences is part of CEO Bob Iger’s plans to return Disney to its former glory. Disney went through a few years of struggles after he left the CEO position in 2020, only to return in 2023 after the dismissal of his successor, Bob Chapek.

It’s not just the cruise business that is getting refocused. Disney has also revitalized its film offerings with several box office winners in 2024. Inside Out 2 and Deadpool & Wolverine brought in $1.698 billion and $1.337 billion, securing them the top two box office performances this year. On top of that, Moana 2 is performing well with roughly $455 million in box office sales after two weeks in theaters.

That strong 2024 box office performance, combined with plans for an expanded cruise line, makes a strong argument that Disney is on the right path to winning back fans.

Is DIS Stock a Buy, Sell, or Hold?

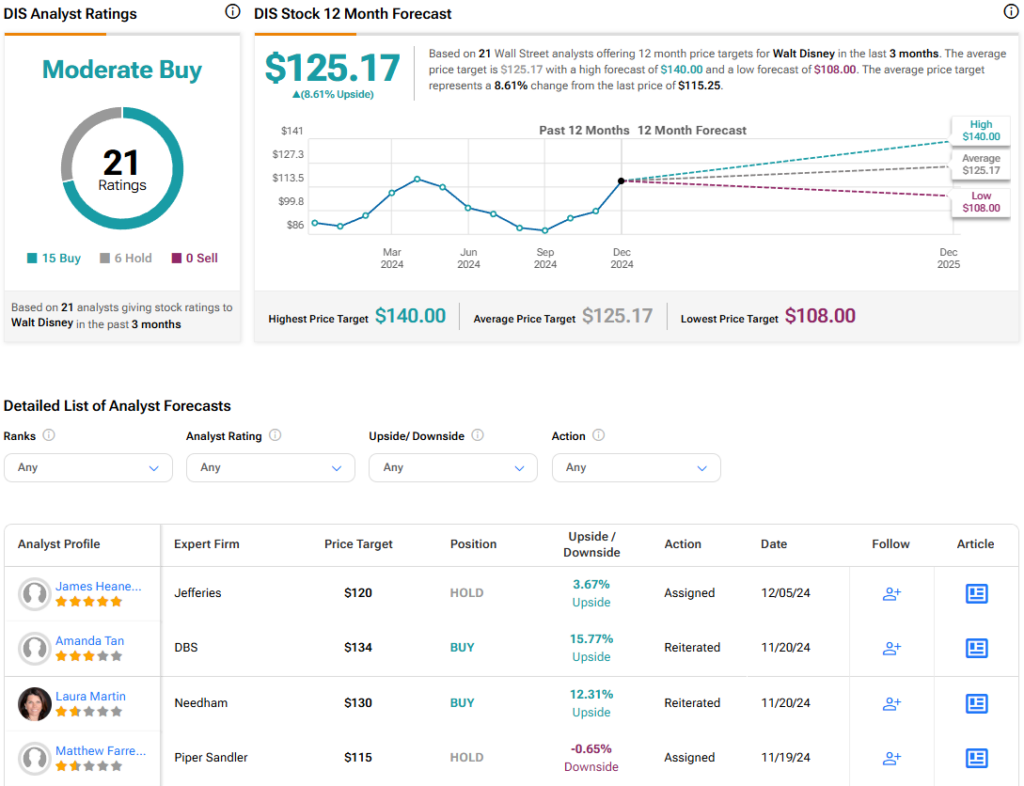

Turning to Wall Street, the analysts’ consensus rating for Disney is Moderate Buy based on 15 Buy and six Hold ratings over the last three months. With that comes an average price target of $125.17, a high of $140, and a low of $108. That represents a potential upside of 8.61% for DIS shares.