The Disney (NYSE:DIS) and Florida drama continues. A little over a week ago, Florida Governor Ron DeSantis fired back at Disney over its opposition to the “Don’t Say Gay” laws in Florida by suggesting that the state could use its power to make Disney’s business very difficult. Difficult up to and possibly including building a new state prison not far from Disney’s doorstep. But Disney isn’t taking this lying down and is launching a new battle of its own. Disney shareholders, however, think the company has bigger fish to fry, and shares are down fractionally in Wednesday afternoon trading as a result.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

This time, Disney isn’t targeting Florida, but rather, the much more vulnerable person of Ron DeSantis himself. Disney alleges that DeSantis is engaging in a political effort aimed at hurting the firm. Disney’s legal forces pulled out all the stops, alleging that DeSantis is violating the Takings Clause, the Contracts Clause, the Due Process Clause, and even the Constitution’s First Amendment.

Disney has been aggressively countering efforts on the part of Florida’s governments to retract the special privileges Disney enjoys as part of the Reedy Creek Improvement District back in 1967. Disney called in not only lawyers but also lobbyists to take on the government and restore its status quo. The suit against DeSantis is just the latest such effort. After all, Disney lawyers noted, DeSantis et al had no trouble with the entire Reedy Creek concept until just after Disney came out in opposition to the new laws in question.

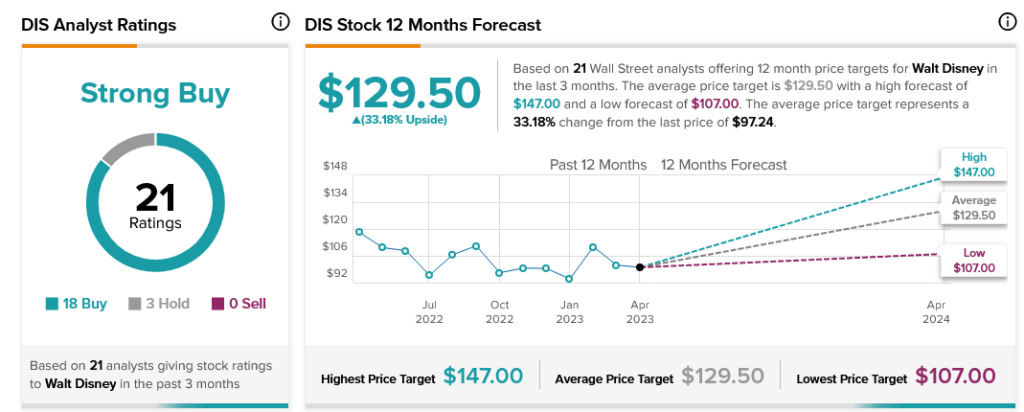

Despite all this legal kerfuffle, Disney is still a leading pick with analysts. By a factor of six to one—18 Buy ratings to three Hold—Disney stock is considered a Strong Buy. Furthermore, it offers shareholders 33.18% upside potential thanks to its average price target of $129.50.