Walt Disney (NYSE:DIS) and activist investor Nelson Peltz are finally parting ways. According to a CNBC report, Peltz’s hedge fund, Trian Fund Management, has sold its entire stake in DIS for $120 per share, resulting in a total transaction value of about $1 billion. It should be mentioned that as of March 31, 2024, Trian was Disney’s fifth-largest shareholder with a 1.77% stake.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

This move follows Peltz’s unsuccessful proxy fight against DIS in April 2024. He failed to secure seats for himself and former Disney CFO Jay Rasulo on the company’s board.

A Brief Background on Peltz and Disney’s Fight

In early January, Peltz initiated a proxy battle against Disney and raised concerns about the company’s succession planning, dividend elimination, rising debt, and streaming strategy. However, the fight was called off after Disney unveiled a strategic restructuring plan to boost growth and profitability.

However, the conflict reemerged in November 2023, when Peltz renewed his activist campaign. He criticized Disney’s lagging performance compared to its peers and falling earnings per share in recent years as major concerns.

Bearish Hedge Fund Signal

According to TipRanks’ data, Disney does not seem to be favored by hedge fund managers. The Hedge Fund Confidence Signal is Very Negative for Disney stock based on the activity of 61 hedge funds. Hedge funds decreased their DIS holdings by 3.2 million shares in the last quarter.

Is Disney a Buy, Sell, or Hold?

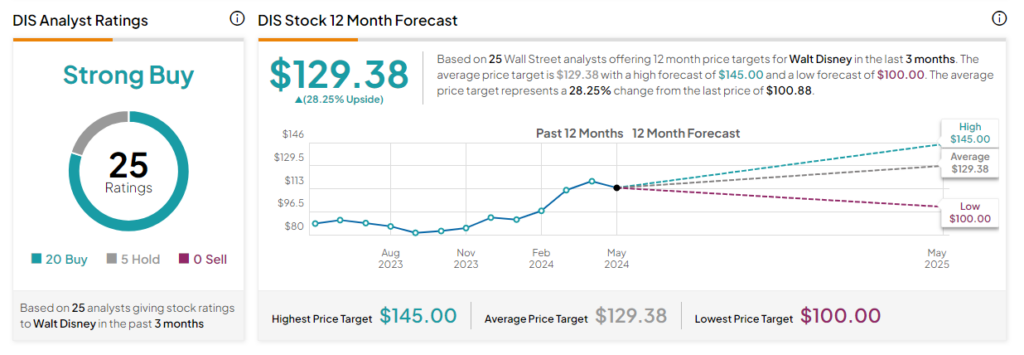

Analysts remain bullish about Disney owing to its efforts to turn around its performance, including cost-reduction initiatives. With 20 Buy and five Hold recommendations, Disney stock has a Strong Buy consensus rating. Further, analysts’ average price target on DIS stock of $129.38 implies 28.3% upside potential from current levels.