Shares of Disney (NYSE:DIS) fell in after-hours trading after the company reported earnings for its second quarter of Fiscal Year 2023. Earnings per share came in at $0.93, which was in line with analysts’ consensus estimate of $0.93 per share. Sales increased by 13.4% year-over-year, with revenue hitting $21.82 billion. This was effectively in line with analysts’ expectations.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Disney’s segment data revealed some wins and some losses. Disney+ now counts a combined total of 157.8 million subscribers to its credit. Domestically, each subscriber now accounts for $7.14 in revenue per month on average, thanks to some price increases. Internationally, meanwhile–except for Disney+ Hotstar–the average went from $5.62 to $5.93 thanks to some currency issues that gave that figure a boost. Disney+ Hotstar, meanwhile, saw a drop from $0.74 to $0.59 thanks to declining advertising.

ESPN+, meanwhile, saw a slight jump, going from $5.53 to $5.64 thanks to more multi-product subscriptions. Hulu, however, saw a drop from $12.46 to $11.73, thanks mainly to a combination of lower advertising and more subscribers going multi-product. Those going whole-hog on Hulu with Hulu Live TV+ saw their average revenue go from $87.90 to $92.32, which was the result mainly of retail price hikes. Though lower advertising rates took some of the wind out of those sails.

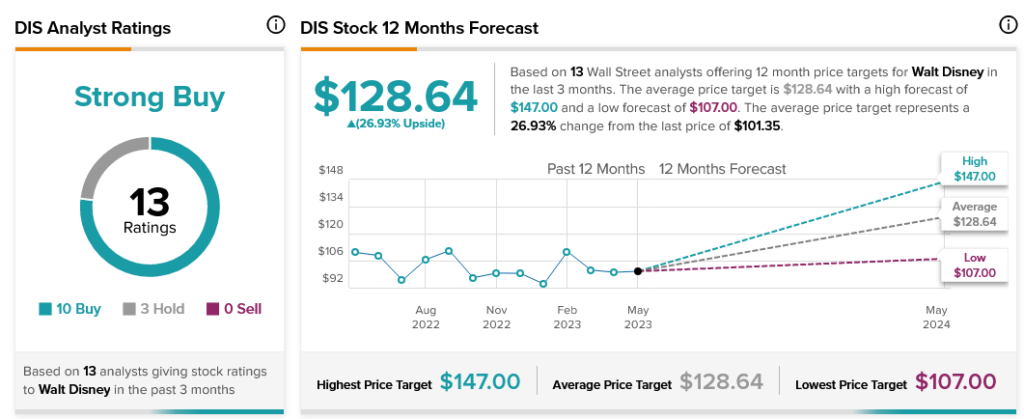

Overall, Wall Street has a consensus price target of $128.64 on Disney, implying 26.93% upside potential, as indicated by the graphic above.