Shares in Digital Turbine (APPS) sunk 10% on Friday despite the software company reporting strong earning results and guidance for the fiscal third quarter.

Specifically FQ2 Non-GAAP EPS of $0.15 beat by $0.04 while revenue of $70.89M surged over 116% year-over-year and beat Street estimates by $10.35M. However GAAP EPS of $0.00 missed consensus by $0.09.

Organic core DT grew ~53% y/y, accelerating ~800bps from F1Q, while Content improved ~47% q/q to ~$21.8M. APPS also revealed that its Application Media software was installed on more than 60M devices during the fiscal second quarter, and has now been installed on more than 500M devices to date.

“Surging advertiser demand for our applications-driven and content-oriented products, along with efficient capital allocation and disciplined operating expenses, enabled us to generate $16.5 million in non-GAAP adjusted EBITDA and $21.5 million in non-GAAP free cash flow during the fiscal second quarter” cheered Bill Stone, CEO.

Looking forward, APPS now expects for its fiscal third quarter: revenue of $72M -$75M, Non-GAAP adjusted EBITDA of $17M – $18M and Non-GAAP adjusted EPS of between $0.15 – $0.16, based on 97M diluted shares outstanding.

“Revenue and adj. EBITDA came in 15% and 50% above our estimates, respectively, one of the strongest quarters we have ever witnessed” commented Oppenheimer’s Timothy Horan post-print.

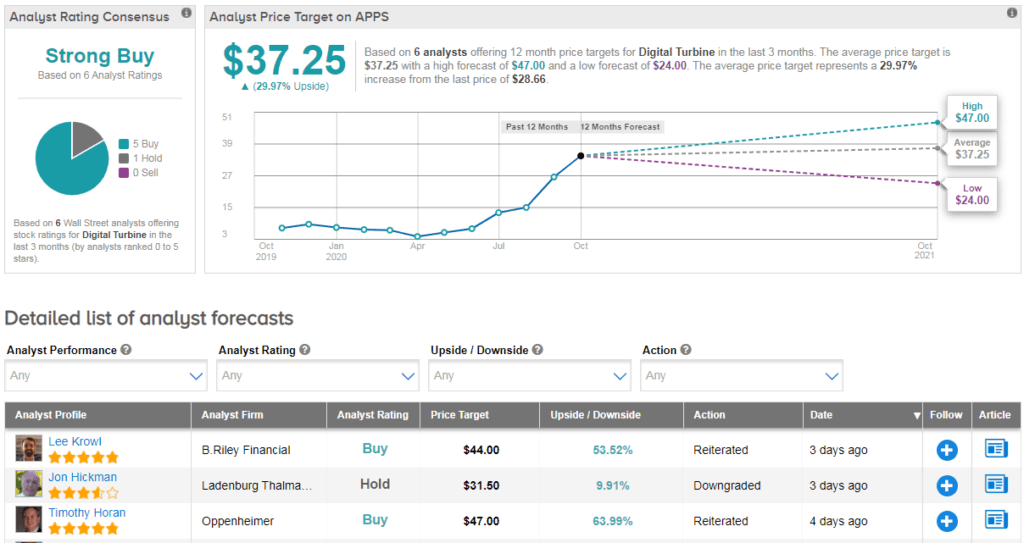

He has a buy rating on APPS with a price target of $47- up from $23 previously. Despite shares surging over 300% year-to-date, his new price target indicates a further 64% upside potential lies ahead.

“APPS is the best/least expensive way to get new applications and content delivered to smartphones and now smart TVs. Recurring revenue jumped to 50% of total from 40% last quarter. International saw 100% growth, and just starting to grow” cheered Horan. (See APPS stock analysis on TipRanks)

However Ladenburg Thalmann analyst Jon Hickman downgraded Digital Turbine to hold from buy, although he boosted his price target to $31.50 from $21. Even though APPS delivered “another impressive quarter” Hickman believes that the stock’s valuation now warrants a downgrade.

Overall analysts have a bullish Strong Buy consensus on APPS with 5 buy ratings vs just 1 hold rating. Meanwhile the average analyst price target of $37 indicates upside potential of 30% from current levels.

Related News:

Ares Management Makes $4.5B Takeover Offer For Australia’s AMP

Carlyle To Buy Flender From Siemens In $2.4B Deal; Analyst Sees 65% Upside

Facebook Drops 6% on ‘Uncertain’ 2021 Warning; J.P. Morgan Raises PT

Questions or Comments about the article? Write to editor@tipranks.com