Digital Turbine (APPS), a software company, beat earnings and revenue estimates in the fiscal fourth quarter. The company simplifies content discovery and delivers relevant content directly to consumer devices.

Following the announcement, shares of the company gained 1.5% in Tuesday’s extended trading session after closing 2.3% higher on the day.

The company reported revenues of $95.1 million in fiscal Q4, which surpassed the Street’s estimates of $88.01 million and jumped 142% from the year-ago period.

Adjusted earnings soared 400% to $0.25 per share, beating the consensus estimates of $0.19 per share.

Digital Turbine CEO Bill Stone said, “Coming off of the breakout performance in fiscal 2021, we are even more excited about fiscal 2022 and beyond. The combination of Digital Turbine, Appreciate, AdColony, and Fyber position us as a company with greater than $1 billion in profitable annualized revenue. This full ad-tech scale, combined with our independent approach and unique on-device technology, provide us with the opportunity to significantly increase our share of the $300+ billion mobile media advertising market.” (See Digital Turbine stock analysis on TipRanks)

For the first quarter of Fiscal 2022, the company expects revenue to be in the range of $188 – 192 million, versus the consensus estimate of $101.9 million. Non-GAAP earnings are projected to be $0.31 per share, above analysts’ expectations of $0.21.

Following the results, Canaccord Genuity analyst Austin Moldow lifted the stock’s price target to $86 (27% upside potential) from $85 and maintained a Hold rating.

Moldow commented, “We believe Digital Turbine’s multiple arbitrage strategy is a worthwhile one, but we are not yet rewarding the entire stack with APPS’ previous premium valuation. Though we continue to like much of the fundamentals, we want to wait to see the progress of such integrations and we believe the landscape is becoming increasingly more competitive.”

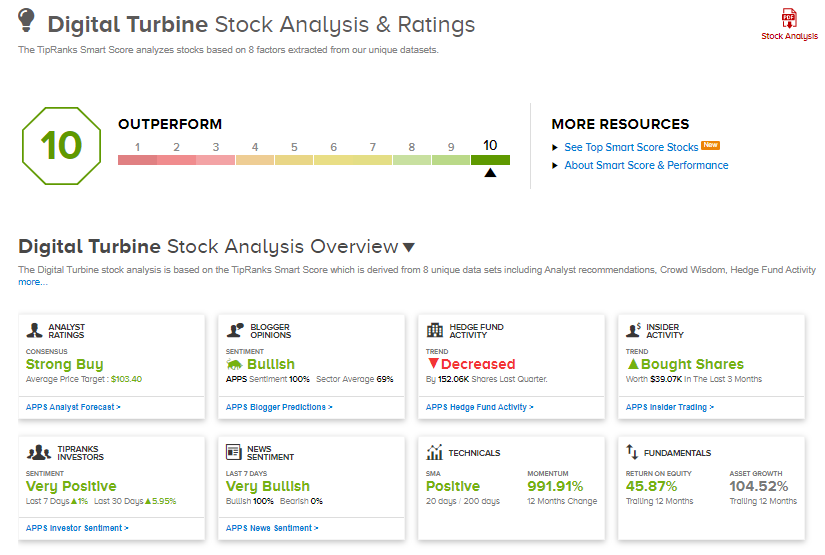

Consensus among analysts is a Strong Buy based on 4 Buys versus 1 Hold. The average analyst price target stands at $107.60 and implies upside potential of 58.9% to current levels. Shares have soared 887% over the past year.

Digital Turbine scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Encompass Health to Redeem $100M Worth of 5.125% Senior Notes

MGM Resorts’ BetMGM Inks Partnership Deal with NYRA Bets for Horse Race Wagering

Surgery Partners & UCI Health Collaborate to Enhance Surgical Facilities